Hi fellow investor,

( Disclosure: I own shares of Andhra Paper Ltd and hence my views on the topic may be biased. Everything I conclude in the article is solely my opinion, based on publicly available information. This should not be taken as financial advice. This is purely for educational purpose.)

Let’s get straight into it.

Andhra Paper is an integrated paper and pulp manufacturer with a total production capacity of 241,000 TPA. The Company produces a range of premium grade writing, printing, copier and industrial papers for domestic and export markets. The manufacturing facilities comprise of two mills at Rajahmundry and Kadiyam, both located in the East Godavari District, in the State of Andhra Pradesh. The company was established in 1921, as “Carnatic Paper Mills”, since then the company has had multiple changes in ownership. In 2011, the Company was acquired by International Paper (IP), a $23 billion American pulp and paper company from then promoter LN Bangur. IP acquired a 75% stake in the company for around Rs 19 bn (approx. Rs 474 per share). In 2019, the controlling stake in the Company was acquired from IP by West Coast Paper Mills Ltd. West Coast acquired a 55% stake in the company from IP for Rs 6 bn (approx. Rs 274 per share) and another 17.2% through an open offer for Rs 3 bn (approx. Rs 438 per share).

The Paper Industry-

The India paper industry segmentation comprises of Writing & Printing (W&P), Cartonboard, Containerboard, Newsprint and Speciality papers. The Writing & Printing segment, in which Andhra Paper operates, accounts for ~22% of the industry capacity.

The Indian paper industry is highly fragmented with the top 3 players accounting for around 9% of the market, and small units accounting for more than 60% of the industry. Unlike countries like Indonesia & the US where the top 3 players account for more than 70% of the market, while in China it is around 21%.

Wood pulp accounts for around 30% of the raw materials used for producing paper in India. Due to limited availability of wood fibre in India, waste paper accounts for 50% and agro residue for 20% of raw materials used for paper production. The mills are dependent on imports due to the quality of raw materials.

China is the largest producer (28% share) and consumer (27% share) of paper products, followed by the US with 17-18% share in production and consumption. India accounts for 4% of the global production and 5% of the global consumption of paper products. The per capita consumption of paper in India is approx. 13kg, way behind the global average of 57kg.

The Indian paper industry added significant capacity in the first half of last decade (2011-2015), leading to over capacity. With limited supply of raw materials, it lead to pressure on raw material prices, and due to increase in supply, the producers were unable to pass on the price increases to the consumers, leading to losses for the mills.

The larger players became more cautious with their expansion plans post 2015, and looked at consolidating their position through acquisitions. In FY20, India had 861 paper mills in the country, off which only 497 were operational, showing the stress in the industry, even before Covid hit. The larger players have strengthened their balance sheets in the last five years and are in a better position to pursue inorganic expansion and secure greater economies of scale.

What lead to the improved performance for the Indian paper industry?

Increased environmental norms and regulations, lead to changes in the paper industry in China. China used waste paper as a major source of raw material to produce paper products, due to limited availability of wood. China accounted for 60% of the globe trade of waste paper prior to 2018. In 2018, China banned the import of mixed grade waste paper, leading shutting down of a number of small paper mills due to non compliance. China also changed the import licensing regulations to prevent paper mills below 50,000 tonnes per annum capacity from applying for import permits of recovered paper. As demand from China for waste paper declined, the prices globally for waste paper fell, and as mills in China shifted to wood chips, prices for wood pulp rose. The rise in wood pulp prices, lead to increase in the final paper product prices.

Indian mills which imported waste paper, benefitted from the lower prices of raw material and were able to gain the benefit of the higher end product prices as well. The larger players which had captive forestry ( like JK Paper, TNPL, Andhra Paper) were also able to take the benefit of the increased end product prices and increase their margins.

Threat of Imports from ASEAN countries!

The Indian paper market is growing at 6-7 per cent per annum. Out of the estimated market size of 18.6 million tonnes, imports have cornered 15 per cent of the market. The paper mills situated in South East Asia have distinct advantage compared to the Indian counterparts. The local governments there have promoted commercial wood plantations, which has reduced the cost of wood for the mills considerably.

Under the FTA agreement, India has progressively reduced the basic customs duty of paper products to nil for most products from Jan 2014. Under the India-Korea CEPA, the basic customs duty was also progressively reduced and came down to 0 per cent with effect from January 2017. In 2018, India imposed anti-dumping duty on uncoated copier paper imported from Indonesia, Thailand, and Singapore. The ADD was for a period of three years, and will end on December 2021. JK Paper with support from West Coast and TNPL, have applied for the extension of the ADD beyond 2021, and hence the DGTR started a sunset review investigation on May 2021.

Further changes in the Environmental regulations!

In 2020, China accounted for approx. 29% of the recycling of global waste and scrap paper market. Since 1 January 2021, a full ban has been in force in China regarding solid waste imports, which also includes all paper waste. Indonesia has also announced similar plans to curb waste imports. In 2020, China (9mn tonnes), distantly followed by Germany (4.3 mn tonnes), Indonesia (2.8 mn tonnes), the Netherlands (2.7mn tonnes) and India (2 mn tonnes) were the main importers of waste paper.

The European Commission adopted new rules on the export, import and intra-EU shipment of plastic waste, from 1st Jan 2021. Exporting hazardous plastic waste and plastic waste that is hard to recycle from the EU to non-OECD countries have been banned. Exporting clean, non-hazardous waste (which would include waste paper) from the EU to non-OECD countries will only be authorised under specific conditions. The importing country must indicate which rules apply to such imports to the European Commission. The export from the EU will then only be allowed under the conditions laid down by the importing country.

Effect of these regulatory changes!

Large players in China have already setup pulping facilities in US & Malaysia, to export pulp made from waste paper to China (still a small part of the overall demand). India, Vietnam and Malaysia, among others, have started to increase the volume of imported paper waste, thereby partially sustaining the global recycling balance. A decline in the global export and import of waste paper products is expected with increased environmental standards in particular countries.

Prices of domestic waste paper have soared in China, due to the ban on imports, and the increased demand for wood pulp, has also lead to higher prices of pulp and paper products.

Covid related disruptions!

The paper industry in India contracted 15% in FY21. While the packaging paperboard segment, registered a marginal growth of 2%, with demand from E-commerce and pharma sector supporting growth, despite moderation of demand from FMCG and consumer durables sectors. While the writing & printing segment contracted by 40%, due to closure of schools and colleges, lower demand from office space, fall in advertising spends on billboards, lower demand from Government for printing materials like, dairies, festival greeting cards etc.

The rising shipping costs and lower availability of waste paper (due to lower paper generation and waste collection globally), has lead to significant rise in cost of raw materials.

Since China has banned import of waste paper, Chinese companies have started importing Kraft paper from India, which is turned into pulp and used to produce higher quality paper. This has lead to increase in India’s export of Kraft paper to China from zero in 2018 to 2 mn tonnes in FY21. This is around 20% of India’s Kraft paper production, which is the raw material for the packaging industry, leading to shortage of raw materials and rise in prices.

Bringing it all back to Andhra Paper-

Andhra Paper has two manufacturing facilities, the Rajahmundry Mill with capacity of 177,000 mt and a bleached pulp capacity of 191,000 mt., and the Kadiyam Mill with capacity of 71,000 mt. The Rajahmundry Mill uses Casuarina, Eucalyptus or Subabul wood, while the Kadiyam mill uses recycled fibre and purchased pulp to produce paper products. Andhra paper has a very successful farm forestry program, and it generates more wood on the earth than they can consume (at more than double the rate of consumption). In FY21, the company procured 100% of its raw materials needs within a 300km radius of its mills, with 37% of the raw materials being procured within a 150km radius of the mill. The major costs for a paper mill are raw materials (pulp and chemicals), power and wages. By reducing the procurement distance, the company has been able to reduce their cost of raw materials. Andhra Paper aims to procure 51% of their raw materials from within 150km radius of its mills, by 2026. Operational efficiency is key for paper mills to improve their profitability due to the capital intensive nature of their industry.

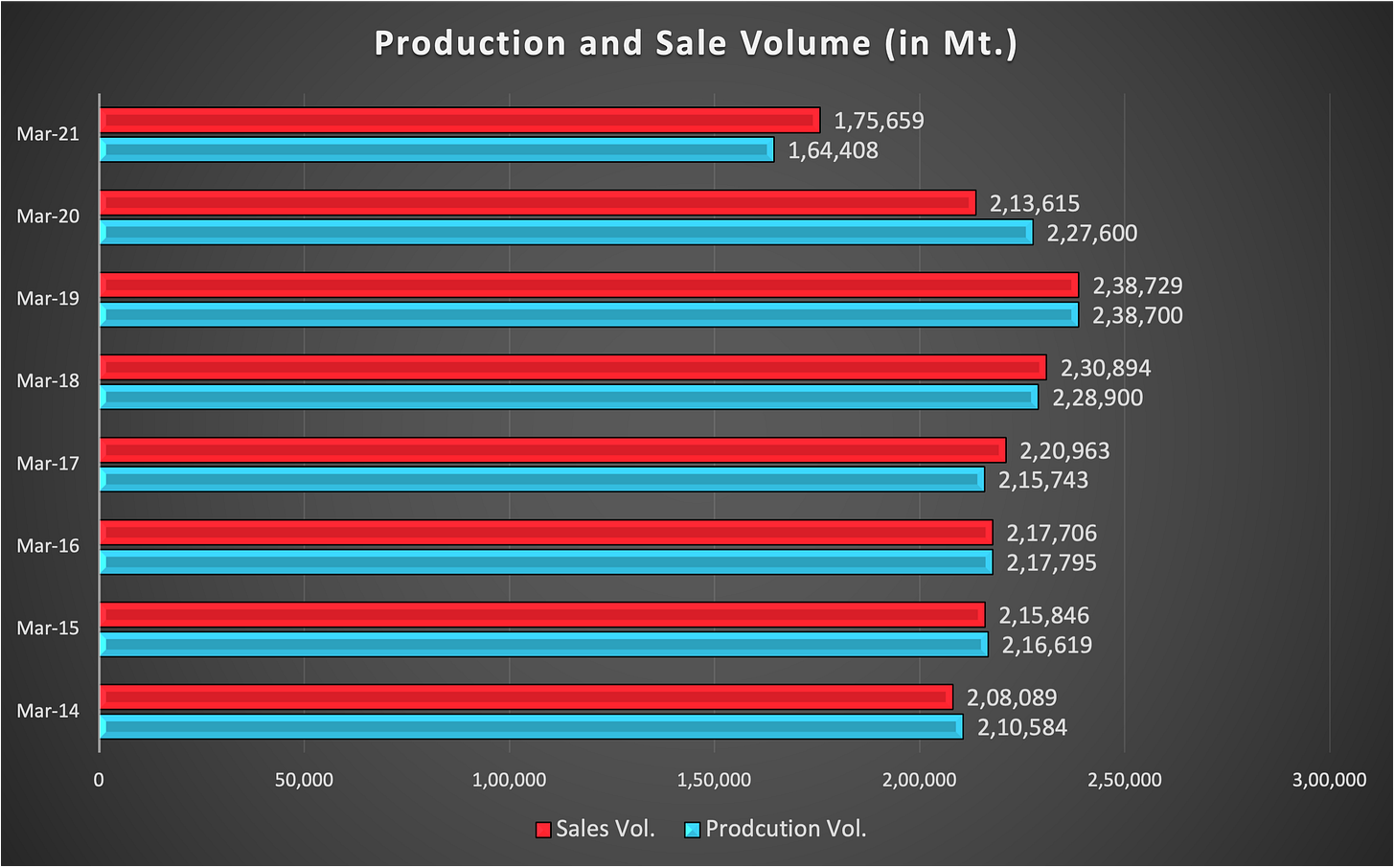

While Andhra Paper has managed to reduce the cost of raw materials and power, labour costs has been rising for the mill. There has been multiple instances of labour strikes in their mills in the last five years as well. The company has clearly benefitted from the rising final product prices ( see increase in realisation in FY19-FY20), and the farm forestry program has allowed the company to continue reducing raw material procurement costs.

Andhra Paper mainly produces uncoated writing and printing paper, which are of three varieties- Creamwove ( for textbooks, diaries, etc.), Maplitho ( for office use like invoices, cashbooks, etc.) and Cut-size ( multipurpose papers used for photocopying, documentation etc.). Andhra paper also produces a variety of speciality paper including coated papers(used in invitation cards and posters) and cupstock, which are used in paper cups and plates. Andhra Paper started producing the cupstock variety in FY19, and did about 23,990 mt. of sale volume in FY21 (i.e 14% of total sale volume).

Peer Comparison -

Outlook-

The paper industry is extremely volatile, with prices fluctuating with change in the demand and supply dynamics. The industry ended FY19 with high inventories, and the contraction in demand in FY20, caused the pulp prices to fall. The paper industry globally has contracted in the developed economies and covid has only accelerated that move. Asian economies like China and India, are the major markets still showing growth in paper demand, with rising populations, improved access to education and move towards more sustainable packaging solutions.

On the supply side, according to the report from Hawkins Wright- “Following the two-year hiatus in capacity growth (FY20-21), some 5.8Mt of additional supply (of bleached chemical pulp or BCP) is due to hit the market, of which 2.3 mt. and 2.7mt. in 2022 and 2023 respectively, hailing the start of the next investment cycle. Confirmed projects thus far imply that capacity growth will then slow to +0.8 mt. in 2024.” The increased demand for wood pulp from China, should cancel out some of the increase in pulp capacity. The imports of wood chips by China increased by 10% in 2020. Although, rising demand and prices can bring back capacities that were curtailed in the past year, albeit with a delay.

According to Hawkins Wright- The capacity dedicated to paper grade production will remain relatively unchanged (+0.3Mt) through the till 2024, with most of the capacity coming in for UKP ( used for tissues), fluff ( used in diapers and female hygiene products) or DWP ( used in cellophanes or rayon) production.

In India, most of the recent capacity expansion announced has been towards Kraft paper and are being brought in to fulfil the rising demand internally and from China. Among the larger players, JK Paper has announced capacity expansion of 170,000 mt. for packaging boards, Seshasayee is upgrading their machines which will increase their paper production capacity by 35,000 tn/yr, and Satia industries is expanding their writing and paper capacity by 100,000 tn/yr.

Andhra Paper is mainly focussed in the Writing and printing segment, but the management has indicated that they are looking at the packaging segment as a “growth opportunity” for the company. West Coast is already present in the packaging segment and the management feels they have the expertise to guide AP as well. Andhra Paper is in a much stronger position financially, and have generated significant free cash flows in the last five years, allowing them to retire most of their debt.

The company’s mills are in a great location- with easy access to coal and water, as well as the largest farm forestry programme in the country spread over 265,000 hectares (4,066 hectares within a 150km radius to the mills), with a cumulative 1.8 bn saplings planted till FY21. This puts the company on great footing to expand their operations from here, as well as deal with any downturn in the industry.

The revival in their revenues will depend on the return to normalcy in the country - as schools and offices re-open, the improved pace of vaccinations gives some hope in that direction. In the long run, rising e-commerce and plastic bans will help demand, but at the same time the move towards a cashless society will lead to contraction in paper demand, both need to considered carefully.

Hi!

If you liked the above letter, consider subscribing to our newsletter. Kindly share this with your friends/family, who you think would be interested in this as well.

If you are interest in reading more about the paper industry- these two articles were great help to me as well- 1) Indian Paper Industry by Divya Chawla

2) Investec Report on the Paper Industry

We will be posting one such article every month. See you soon!!

Thanks for reading!!

You can also find us on Twitter.