Hi fellow investor,

( Disclosure: I do not own shares of Bata India Ltd. My views on the company may be biased. Everything I conclude in the article is solely my opinion, based on publicly available information. This should not be taken as financial advice. This is purely for educational purpose.)

Let’s get straight into it.

Background

“Bata” has been such a ubiquitous brand in India, that most Indians never associated it as being a foreign company (as you may know, Bata is a Czech company, headquartered in Switzerland, more on its history here). It was amusing to learn that the same situation exists in other countries like Indonesia as well. Bata entered these countries much earlier than other brands (they entered India in 1931 and Indonesia in 1939), and ingrained itself into the society by setting up manufacturing facilities & townships around those facilities (Batanagar in India & Cali-Bata in Indonesia). They had low competition (at least early on), and the affordable nature of their products made them household names.

Bata India first went public in 1973. During that time it was known for its rubber slippers under the brand ‘Hawai’, as well as school shoes under the brands ‘Naughty Boy’ and ‘Ballerina’. In the 80s, they launched the brands North Star (youth focused), Marie Claire (women footwear) as well as Power (sport shoes). From 1991, the liberalisation policies, brought in lots of competition. To improve its image, Bata launched ‘Hush Puppies’, to showcase its premium range of products. But Bata continued to struggle, as its brand image faltered and labour issues at its factories and showrooms further hampered progress. Bata India appointed Marcelo Villagran (then the Bata Chile- CEO) as the MD in 2004, undertook massive layoffs, and shut a number of its loss making stores. The company posted losses for three consecutive years from 2002 to 2004, before coming back to profitability in 2005. They started renovating their existing stores, revamping their stock to higher margin products, and the manufacturing was streamlined to mostly specialised variety of shoes while outsourcing was increased. Marcello resigned in 2011, as he was promoted to Bata Group MD. In his 7yr tenure, Bata India saw revenues increase from Rs 7.3bn to Rs 16.9 bn (12.8% CAGR) while net profit went from loss of Rs 628 mn to profit of Rs 2.2bn. An excellent comeback!

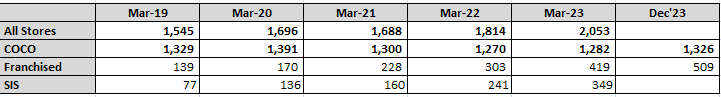

In 2011, Rajeev Gopalakrishnan became MD. The plan was to shift gears from consolidation to expansion, they wanted to appeal to the younger generation and increase store penetration in tier 2 and 3 cities. The company in the next 7+ years (till March 2020) managed to increase sales at a CAGR of 7.2%. The store count increased from 1250 stores in 2011 to 1696 in 2020 (including 170 franchised stores). Not a bad return given the large base.

Footwear Market

The Indian footwear market is still dominated by the unorganised segment, which accounts for 65% of the market. In the organised sector, the mass segment accounts for 56% of the market, and has been the slowest grower of the pack. The overall volumes in the industry has increased at a CAGR of 4.5% (FY15 -FY20), while the per capita footwear consumption increased to 1.9 pairs from 1.6 in FY15. Thus the growth in the footwear industry has largely come from premiumisation.

The economy and mass segment (i.e. less than Rs 1000 segment) accounted for more than 50% of the sales for Bata in FY15. Bata grew at a CAGR of 6% odd from FY15 to FY20. Bata saw some increase in the growth rate in the second half (FY18 to FY20), as the mass segment started to increase, but this growth was halted by Covid and then by inflation, which dented the consumption in rural India significantly. But given the growth rate in the footwear market, the company has lost market share to peers.

New Management and Strategy

Since FY20, Bata India has undergone change in management as well as strategy. In FY22, Gunjan Shah was brought in as the new MD and CEO, he was previously the Chief Commercial Officer at Britannia. The previous MD Gopalakrishnan is now the head of Bata Asia Pacific, and the previous CEO Sandeep Kataria, is the CEO of Bata Global (the parent).

Under the new head, Bata India has launched a new campaign- ‘Sneaker Studio’ to increase the focus on the growing casualisation and premiumisation trend (all renovated stores would have wall display of different sneakers). They also launched a new brand ‘Floatz’ which is a premium casual wear brand (similar to Crocs). The company closed the company owned stores which were loss making or not giving the required returns, and focussed more on expansion in tier 3- 5 cities (deeper penetration in semi urban and rural areas) through franchisees. As of December 2023, the company has 1326 company owned and operated store (COCO) and 509 franchises. The company has also undertaken renovation of the COCO stores under the new Bata Red 2.0 concept, which they say is more inviting and fresher than old stores, and plans to complete renovation of 80% of their stores in the next 2 yrs. These renovations have brought down the average store age to 7 yrs, with a target of bringing it down to 6.5yrs in the next couple of years.

Current Situation

In FY23, Bata India sold 48.5 mn pairs of shoes, compared to 49.4 mn in FY20, though the ASP (Avg. Sales Price) has increased from Rs 618 to Rs 712. A large part of this increase is due to the premiumisation in the portfolio, as the sales contribution from the ‘less than Rs 1000’ segment has fallen from 50% in FY20 to 34% in FY23.

While the premium shoes are selling more, volume of shoes sold per store is down, the only caveat is that the store network is quite different now. The franchise stores have increased from 170 to 419 and the COCO stores decreased from 1391 to 1282. The franchise stores are smaller than COCO stores and in relatively smaller towns. The reported sales to the franchisee is lower than actual sale price of the item (30-50% lower depending on the item, as thats the gross margin for the franchisee). So the ‘actual’ ASP of the product would be even higher than 712. The volume is indeed lower than pre-covid despite more stores, but due to the higher no. of franchise stores, it’s not a like to like comparison. Nevertheless, the consumption in the mass segment has been very weak (the high volume segment) and hence, the volumes are down.

Capital Light Expansion, Better OPM!

This change in the network composition is here to stay as well. While the COCO stores have started increasing again, 80% of the store network growth will lead by the franchises, according to the management’s new strategy. The franchises allows the company to open stores in locations where a COCO store wouldn’t have been a viable option. The company is also opening more than 50% of the new franchise stores with existing franchise owners (target is to take to 60%), showing this a viable business plan for the franchise owners as well. This is also beneficial for Bata’s capital efficiency - they will ideally have higher operating margins (though lower gross margins) from the franchise business, and will have to spend very little capital- as the franchise owner is doing the capex for the stores, while Bata needs to spend on training the employees early on and brand promotion. This should increase the Free Cash flow generation for the company.

Bata will have to open multiple franchises to match the sales from a COCO store. Bata is selling at a lower rate to the franchise (30%-50% lower), and the franchises are in smaller localities, so the sales are also lower than a typical COCO store (around 60% of a COCO store), the net result is that the sales contribution from a franchise store is around 0.3x-0.4x of a COCO store.

Bata.com

Another reason for the lower increase in COCO stores, is the proliferation of online sales. Online sales made up 10% of the total sales for Bata in FY23. Bata has set up its own online e-commerce store while also selling merchandise at other marketplaces like Myntra, Amazon, Nykaa etc. Bata has set up an omnichannel network of 1600+ stores that includes all its COCO stores as well as most of its franchise stores, which all act as inventory and delivery points for its online store. In the nine months ended Dec’23, the company has shipped 4.1mn shoes.

Capital Efficiency

Despite the low growth, the company has still been consistent with RoCE (the recovery in profitability from FY17 to FY20 is visible here). This is due to the low incremental capital requirement from the company. The move towards more franchise lead growth, will further reduce the capex requirement for the company. The company has paid an increased dividend of Rs 54.5 per share in FY22 and Rs 13.5 per share in FY23. This reduced the cash balance from Rs 10.97 bn at end of March 2021 to Rs 4.2 bn in September 2023.

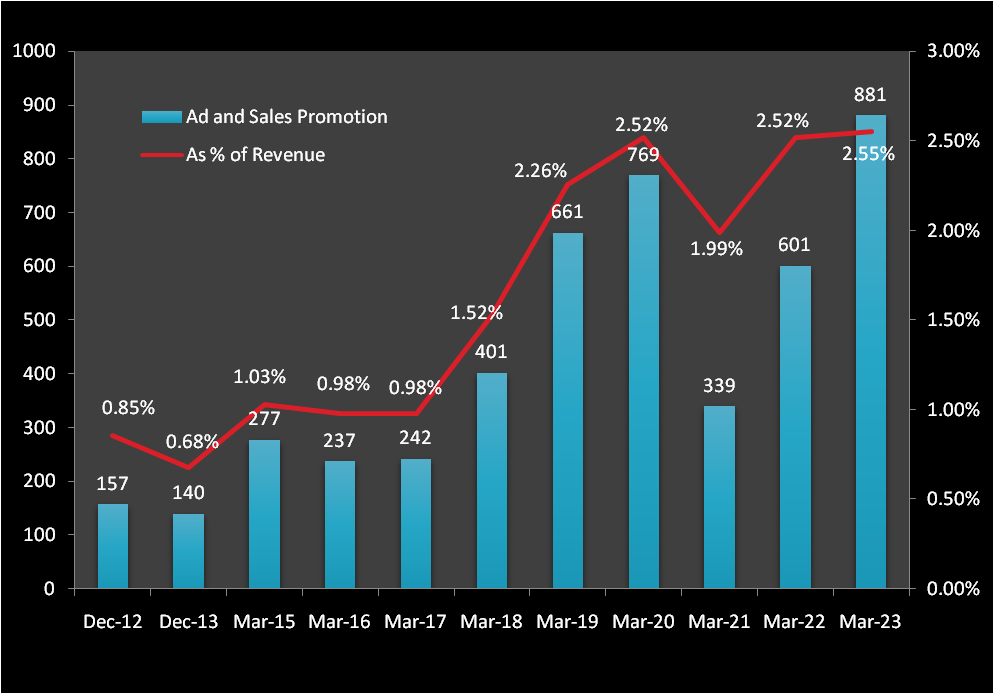

With lower capex going forward, the company will be spending higher on branding and promotions. While the company increased ad spending pre covid, these spends should further increase with the company increasing focus on their individual brands like Power, North Star, Floatz, and pushing more digital and influencer lead marketing. The company expects ad and sales promotions to increase to 4% of Revenue going forward. This seems like an important change, as the company previously has failed to back its individual brands enough in the past, which meant most have not done well outside the Bata banner.

Peer Comparison

The valuations of the all the top players are extremely high, even comparing to their historical valuations. The margins for the mass segment players (ASP < Rs 1000), like Campus, Relaxo and Bata, are very similar. While Metro has much higher OPM given overall ASP of Rs 1500 approx.

As of FY23, among the four, Campus is spending the most on ads and promotions with 6.2% of Revenue, Relaxo is spending 4.4% while Metro is spending 2.6%. So Bata was at the bottom here, and needed catching up.

Conclusion!

Bata is undertaking a number of different measures to boost growth, whether it’s keeping around 30-40% fresh stock at the start of every season (6 month cycle- Jan to June, July to December) or adding new brands to their portfolio like Floatz (premium casual wear). The company has also signed an exclusive agreement to launch ‘Nine West’ in India, an American shoemaker with $1bn in retail sales globally. Bata will be manufacturing and selling these exclusively in India, and the ASP is expected to be even higher than Hush Puppies. After a break due to covid, the company is also looking to expand the Hush Puppies exclusive store network, with a push towards pop up stores (smaller standalone stores). They are going to add the ‘Power’ brand to the ‘Sneaker Studio’ line up and back it with showcasing their shoe technology. The company has also launched a pilot for ‘Power Activewear’ (Power branded apparel) in 60 stores, and will be looking to learn from this before expanding this across the network. The company is also experimenting with standalone pop up stores for the ‘Floatz’ brand, with 10 stores currently. All this is an effort to increase the premiumisation in the portfolio. The company still has a large footprint in the rural and semi urban space (which is only increasing with the franchise push), and they would like to capitalise on the mass segment sales whenever that picks up. So it seems like the company is taking all the steps to regain its lost market share and move up the ASP chain. The issue remains the immense competition in this space- with the likes of Decathlon, Asian shoes, and a number of smaller D2C brands entering, and while Bata has a distributional advantage, they haven’t had many successful individual brands in the recent history. While Bata was late to the ‘sneaker’ and ‘premiumisation’ trend, they seem to be catching up now, can they make a “comeback” again remains to be seen…

Hi!

If you liked the above letter, kindly share it with your friends and family. We have covered a number of other companies as well- Sequent Scientific, Restaurant Brand Asia, CIE India, L&T Finance, among others. You can check those out here.

See you soon!!

Thanks for reading!!

You can also find us on Twitter.