Hi fellow investor,

( Disclosure: I do not own shares of Hester Biosciences Ltd. My views on the company may be biased. Everything I conclude in the article is solely my opinion, based on publicly available information. This should not be taken as financial advice. This is purely for educational purpose.)

Let’s get straight into it.

Little bit of Background…

Hester Biosciences is one of the leading animal healthcare companies in India, and the country’s second-largest poultry vaccine manufacturer. The company was founded by Rajiv Gandhi (current MD) in 1987, and is headquartered in Ahmedabad, Gujarat. Mr Gandhi began his career as a distributor of poultry health products in Mumbai. He later ventured into manufacturing these products in collaboration with an American partner, who accepted equity in exchange for technology. They raised money through an IPO in 1994, under the name of Hester Pharmaceuticals Limited to fund the manufacturing set up. Their first batch of poultry vaccines was rolled out in 1997. In 2003, they terminated the collaboration agreement with the American company. Hester has come a long way since then; they now operate through two broad verticals— Vaccines, and Healthcare Products, offering 50+ vaccines and 70+ healthcare products. As of September 2023, Hester has a capacity to deliver 13.45 billion doses in India, 1.24 billion doses in Nepal and 1.50 billion doses in Tanzania. Hester also has two diagnostic labs operational in Kadi, Gujarat and Hyderabad, Telangana.

The need for vaccines…

“India has vast resource of livestock and poultry, which play a vital role in improving the socio-economic conditions of rural masses. There are about 303.76 million bovines (cattle, buffalo, mithun and yak), 74.26 million sheep, 148.88 million goats, 9.06 million pigs and about 851.81 million poultry as per 20th Livestock Census in the country.”- Department of Animal Husbandry and Dairying (Annual Report 2022-23)

“A significant obstacle in growth and production of livestock and poultry is the prevalence of diseases that cause huge economic losses in India. The outbreaks of Foot-and-Mouth disease and haemorrhagic septicaemia in cattle and buffaloes; PPR, goatpox, sheeppox, and orf in goats and sheep; have underlined the adverse impact of these diseases on livestock and poultry productivity. The most effective way to overcome the loss from diseases and increase livestock productivity is through prevention of diseases using vaccines. Foot-and-Mouth disease and haemorrhagic septicaemia inflict huge economic losses amounting to ~ Rs 140 bn and Rs 53 bn every year, respectively.” - Indian Council of Agricultural Research.

National Animal Disease Control Programme (NADCP)- It is a flagship scheme launched by the Hon'ble Prime Minister in September 2019 for control of Foot & Mouth Disease (FMD) and Brucellosis by vaccinating 100% cattle, buffalo, sheep, goat and pig population for FMD and 100% bovine female calves aged 4-8 months for brucellosis (brucella) with a total investment of Rs 133 bn for five years (2019-20 to 2023-24).

The Department of Animal Husbandry and Dairying also received an allocation of Rs 43 bn, an increase from Rs 31 bn in the revised projections for 2022-23. A significant part of the total allocation went to the livestock health and disease control programme, amounting to Rs 23 bn.

With growing population and increasing income levels, the demand for animal protein such as milk, eggs, and meat is on the rise. This has led to an increase in the number of livestock, which in turn has created a need for better animal health management.

Let’s Talk Business…

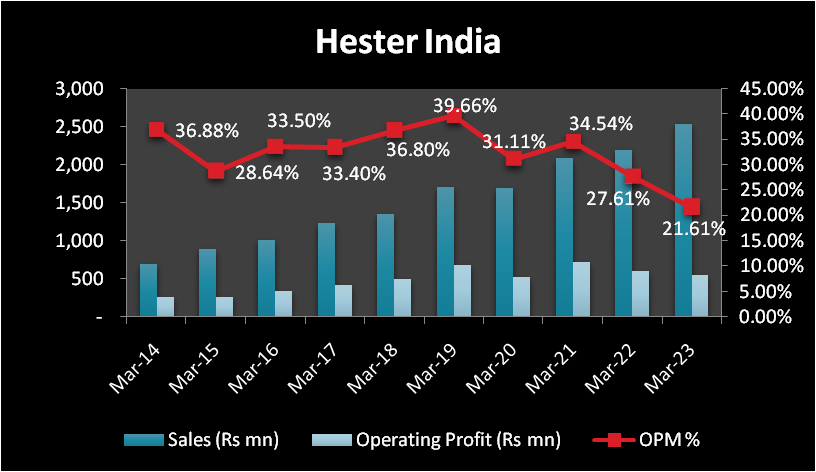

In the last five years, while the Hester India has increased Revenue at a CAGR of 13.5%, the Operating Profit has only increased at a CAGR of 2%. This fall in margins, can be attributed to the poultry industry taking a downturn after Covid.

The company started as a poultry vaccine manufacturer, and has since garnered a 30% market share in the Indian poultry vaccine market. This is a mature market with 3 large players, Venky’s (leader with 40% market share), Hester and Indovax. Thus the growth in this market for each player is more dependent on the market itself growing. The poultry vaccine market is dependent on the underlying poultry industry which can be highly cyclical. Feed (maize and soya) makes up for the majority of the production costs and any increase in the prices there can lead to disruption in the business- higher feed prices, with end consumer prices being much more sticky, leads to lower production of poultry animals, and hence lower demand for health products.

Hester wanted to diversify away from a single segment, so they started to expand their base- both on the product side as well as geographically. In FY13, they added a ‘large animal’ division to their Ahmedabad plant, to manufacture ‘large animal’ vaccines. In FY15, they launched their first animal vaccines for PPR (Peste des petits ruminants- aka sheep & goat plague) and Goat pox.

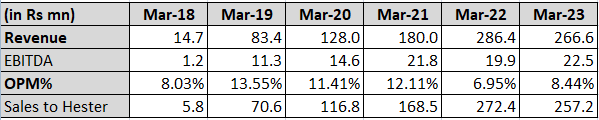

In 2013, Hester started an Animal Health division to sell health products (medicines, feed additives, etc.) for both poultry and large animals, utilising their existing sales and distribution network. Hester decided to not set up their own factory for health products and was buying from manufacturers, who were in and around their existing facilities. In 2018, they acquired a 55% stake in Texas Life sciences, for Rs 28 mn, and shifted all their health product manufacturing to them. This gave them more control over the manufacturer, as well as eased the registration process for their products in foreign countries.

By FY10, Hester had started the process of getting their products registered in other countries- mainly Africa and Middle East. They started with the poultry vaccines, before moving to large animal vaccines and health products. The major issue with exports is it takes time to register and get approval for the products- ranging from 6 months to 3 years. To do a sizable amount of exports, a company needs to have a distribution network in these countries to access the private markets there. Also a lot of the exports are dependent on the tenders from international organisations like the FAO (Food and Agriculture Organization of the United Nations), which are sporadic at best.

In 2011, Hester announced plans to set up a manufacturing facility in Nepal, under a 65:35 JV agreement with a local businessman. The plant was projected to cost Rs 150 mn and be commercialised by end of March 2013. The plan was to manufacture specific large animal vaccines (mainly PPR vaccine) and export it to African countries, under tender from the FAO. The PPR vaccine manufactured in India is of the Sungri strain, but elsewhere the Nigerian strain is used, which cannot be manufactured in India. The plant ended up being commercialised in 2016, after numerous delays due to political unrest, restrictions on sending equipments from India, as well as the Nepal Earthquake. The final cost was closer to Rs 400 mn. The plant has a 1.5bn dose capacity, and revenue potential of Rs 500 mn. The company though has been unable to fully utilise this facility yet, as the FAO tenders haven’t come as expected and been of much smaller size. The management has pointed out on many occasions that they had discussions with the FAO but haven’t got any certainty on when the orders will come. The company since have set up their own distribution points in Africa, and have been working to get the products registered and deliver the products directly to the governments and private markets, though the demand since Covid has been tepid.

Hence, while the MD was very upbeat about the growth in the export markets (from India and Nepal), projecting 100% growth YoY through FY15 to FY18-19, they missed those targets by a long margin.

African Foray…

Hester initially started with the aim of exporting vaccines from India and Nepal to the African continent, and making the region one of their biggest revenue contributors. But the tender business (from WHO and FAO) didn’t take off as expected.

In 2016, they registered Hester Biosciences Kenya & Hester Biosciences Tanzania, to commence their own distribution operations in these countries. They received a grant of $1 mn from the Bill and Melinda Gates Foundation (BMGF) for the same.

In 2018, they signed an agreement with the BMGF to set up a manufacturing plant in Tanzania, under Hester Biosciences Africa Ltd. Under the agreement, Hester would set up a 1.5 bn dose manufacturing facility in Tanzania by investing $4 mn, while BMGF would grant $4mn and provide a loan of $10 mn (at 3% fixed interest) to fund this project. The MD explained, that the African market was under supplied with health products, with 80% of the vaccines currently being imported from outside, and the prices are 5-10x the international prices in many cases. The plant at full capacity had a revenue potential of $30 mn. MD said that the company had learned from the Nepal experience and would not be depending only on the WHO/FAO for orders. Hester was setting up their own distribution infrastructure in a couple of countries to better penetrate the markets, and signing with distributors for other countries, to access the private markets. Tanzania has the third largest livestock population and is going to be the largest vaccine market in Africa, so would be large enough market for Hester to target initially.

The Tanzania plant was commercialized in FY23, and Hester Africa launched three vaccines: Newcastle Disease vaccine, PPR, and Contagious bovine pleuropneumonia vaccines. However, the sales from the plant haven’t taken off yet as African governments are not in the best of shapes after COVID, with increased inflationary pressures and a lack of USD. While the company has put in effort to make vaccines available “off the shelf”, people are not used to spending on vaccines, and Hester needs to put effort into educating the farmers.

In 2022, Hester bought a 50% stake in Thrishool Exim Ltd, a health products distribution company based in Tanzania, for Rs 210 mn. Hester decided to consolidate all their distribution activities into this company and distribute products from the Hester Africa plant through it. The idea seems to be that it’s difficult to manage distribution in Tanzania from India, and having someone with an interest in the business on the ground will lead to better outcomes. As of September 2023, Hester Africa has registered 6 vaccines, and another 5 are expected to be registered by the end of this financial year. The company is also anticipating that the harmonisation of the regulatory process in Africa will increase access to neighbouring countries and reduce registration times in the future.

BSL-3 Facility

BSL-3 laboratories are used to study infectious agents or toxins that may be transmitted through the air and cause potentially lethal infections. In May 2021, Hester signed an agreement with Bharat Biotech for the manufacture of Covaxin drug substance. They set up a multipurpose BSL 3 facility at a cost of Rs 1bn and were awarded a grant of Rs 600 mn by BIRAC. The facility was awarded approval in 2023, but by that time there was no demand for the vaccine (and hence the drug substance). The company is currently evaluating the market and awaiting approval from BIRAC to repurpose the facility for other use. In FY23, the company received Rs 240 mn from BIRAC, with the balance amount to be released in due time.

Pet Care

Hester launched their pet care division in FY22, with an initial focus on segments ranging from dermatology, grooming, specialty nutrition, anti-infective parasiticides, and specialty products. The company plans to expand into vaccines as well. The distribution is going to be through distributors and veterinarians, and they are also looking to set up an online platform . The business is being handled by the MD’s daughter, Priya Gandhi, who is also the Executive Director at Hester. According to her, the pet business has a lot of emotional quotient attached, which is why the margins are higher but it’s also much more difficult to penetrate. The company is doing a lot of back-end work to establish the brand . The business is in a nascent stage, and they expect to break even in FY24.

So much capital employed for so little return, till now….

Hester increased the capital employed into the business from Rs 2 bn at the end of FY18 to almost Rs 6 bn by the end of FY23. Despite this, the operating profit was still hovering around the Rs 500 mn mark. In this time, the debt-to-equity ratio has doubled from 0.49 to 0.98. The major reason for this is that the company is yet to start utilizing most of the new facilities they built, including the fill-finish and the bulk antigen facility that they completed in FY23, the BSL-3 facility, and the Tanzania plant. This is further accentuated by the fixed and gross asset turns (which don’t include CWIP) falling significantly as well.

The returns on investment for Hester have also fallen due to the falling gross margins, which contracted from highs of 85% in FY20 to 71% in FY23. Employee expenses have also increased from 16% of revenue in FY19 to 21% in FY23, as the company has hired more marketing and sales personnel to expand the reach for their pet care and healthcare products. The contribution of the poultry division, which are their most mature products, decreased from 80% of revenues in pre-COVID to 60% in FY23. Healthcare products such as medicines, herbals, feed additives, etc., took a larger portion of the sales than before, and the margins here are lower than those in vaccines. In FY23 and FY24, the poor economic conditions in the poultry industry also contributed to the fall in the gross and operating margins, as the company was unable to pass on the price increase in raw materials to customers. The MD believes that the company can still achieve the 30% operating margins as the industry conditions improve. The high frequency of sales in healthcare products can lead to higher operating leverage and a better bottom line as well.

Concluding thoughts-

Hester Biosciences Ltd reached its all-time high of Rs 3134 on May 18th, 2021, on news of it entering into a deal to manufacture vaccines for Covid. Since then, it has dropped by 53% to Rs 1500 (CMP). The return from the shares has been flat for almost 6 years (Dec’17 to now), and the operating profit for the company hasn’t increased much in that time. So it’s still trading at an EV/LTM EBIT of 40x (the 10 yr avg EV/EBIT is 30x). In that time, the fixed assets (incl. CWIP) have increased significantly from Rs 1.4 bn to Rs 4.1 bn. In the FY22 Annual report, the MD said he understood the concerns of the shareholders on the delays in execution and the lack of returns from their international projects. He said both- Nepal and Africa, are new markets and require groundwork in building the market & trust, and he was confident they would eventually deliver results. The MD also said they have built for multiple years of aggressive growth, and the focus would be on execution going forward.

While there is no doubt that Hester has built immense assets, capable of showing growth in the future, the reality is that a lot of that growth isn’t in their hands. The company, for a large part, is at the mercy of local governments and international organizations for vaccine orders. Thus, it looks like the company is focusing more on developing the private markets and increasing sales of healthcare & pet products. Although the margins on these products are lower than in vaccines, the MD believes that the overall market for these products would be much larger. The pet care division is at a nascent stage, with half year FY24 sales of just Rs 17 mn.

Hester is currently working towards attaining revenues of Rs 500 cr in the next three years, and regaining the 30% OPM. In India, the company has received few ‘large animal’ vaccine orders from the central government, for Lumpy Skin Disease and PPR, and expects to do about 60cr in sales from these in FY24. Hester and other industry players like Venky’s have also seen some revival in the poultry industry in the Q2 FY24, which could help boost sales in the poultry health division. Thus, Hester India looks to be in much better shape going forward. The revival of Hester Africa and Hester Nepal though depends on improvement in the financial conditions, in the African countries and restarting of tenders.

Hi!

If you liked the above letter, we have covered a number of other companies as well- Sequent Scientific, Restaurant Brand Asia, CIE India, L&T Finance, among others. You can check those out here.

See you soon!!

Thanks for reading!!

You can also find us on Twitter.