Hi fellow investor,

( Disclosure: I own shares of Jubilant Life Science and hence my views on the topic may be biased. Everything I conclude in the article is solely my opinion based on publicly available information. This should not be taken as financial advice. This is purely for educational purpose.)

Let’s get straight into it.

In this letter we will dig deeper into Jubilant’s Life science ingredients business. (We covered the pharmaceutical business in Part 1.)

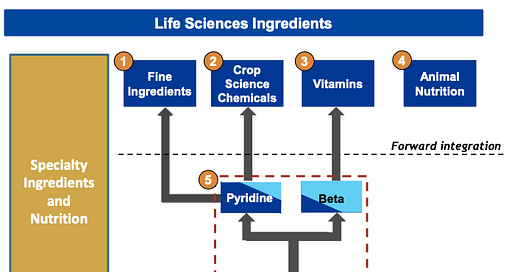

Jubilant Life Science has moved up the value chain in the last few decades, from a bulk chemical producer to a fine & speciality chemical producer to pharmaceutical manufacturer. This has allowed the company to be vertically integrated and expand globally.

Jubilant’s Life science ingredients revenues have been largely stagnant in the last five years. Jubilant is a low cost producer with huge scale, but their products are commoditised, and hence operating margins (OPM) and revenues are unstable. The company has three major segments in the Life Science Ingredients business - Life Science Chemicals ( i.e Acetyls ) , Speciality Intermediates (i.e. Pyridines and their derivatives) and Nutrition Ingredients ( i.e. Vitamin B3 ).

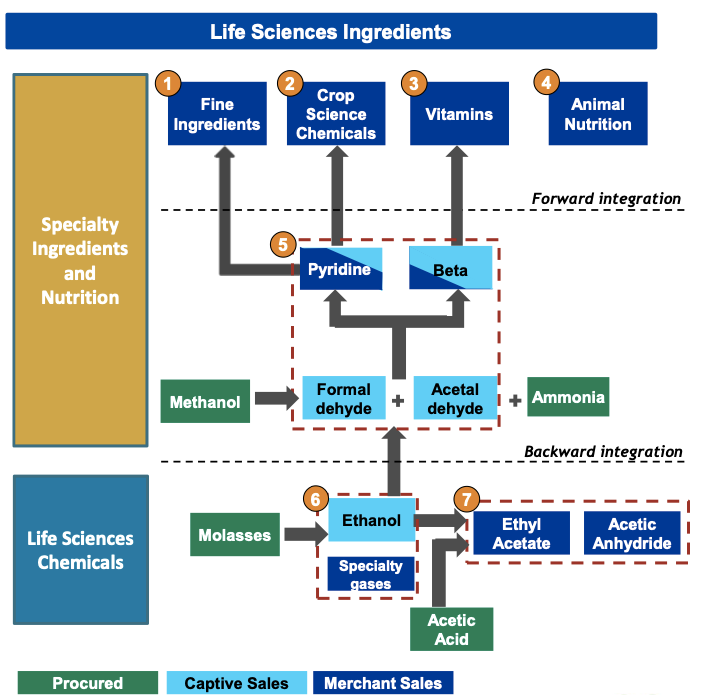

Life Science Chemicals- The Life science chemical business (LSC) produces various organic intermediates (acetyls): vinyl acetate monomer, acetic anhydride, ethyl acetate, etc. which are typically used in the manufacture of downstream products such as pharmaceuticals, crop protection chemicals and other solvents.

Jubilant is backward integrated in the manufacturing process, using molasses (a waste product from the manufacture of sugar from cane) as feedstock, to manufacture ethanol, which is a key ingredient for acetyls. The company has invested in two new plants at Gajraula, Uttar Pradesh and Nira, Maharashtra , with production capacity of 150,000 litres per day. While ethanol is used internally for producing downstream products, the company also supplies fuel ethanol to OMCs. In the Ethanol Blending Programme (EBP) for Dec 2018- Nov 2019, Jubilant supplied 49 million ltr of ethanol to 6 states in India, becoming the 10th largest supplier in the EBP nationally ( Generating revenue in excess of Rs 200 cr). Jubilant also manufacturers high quality ethanol, that is distributed to pharmaceutical, cosmetics and agrochemical manufacturers.

Jubilant is one of the largest consumers of acetic acid in the India. Acetic acid is used in the production of acetic anhydride, ethyl acetate and Vinyl acetate monomer. The changes in the prices of acetic acid affect the margins of Jubilant’s LSC business.

One of the key products of Jubilant’s LSC business is ethyl acetate, made from bio-ethanol and acetic acid. Jubilant is also the 7th largest Ethyl Acetate manufacturer in the world and has the largest market share in the domestic market. Ethyl acetate has wide industry applications, it’s used as an extraction agent in the pharmaceutical industry, used as industrial solvents in the paints, coating and adhesives, and used to make flexible packaging. Prices of ethyl acetate are affected by changes in crude prices, and recent fall in crude prices will affect their revenues.

Jubilant also makes Acetic Anhydride from acetic acid. Jubilant has half of the domestic market share in the production of Acetic Anhydride. It is also the 7th largest global manufacturer of Acetic Anhydride and the 4th largest in terms of merchant sales globally. Acetic anhydride, finds wide application in the textile, pharmaceutical and agrochemical industry. Jubilant has spend Rs 135-140 cr in the last few years, to expand their Anhydride capacity from 100,000 TPA to 145,000 TPA. The company expects this additional capacity to generate revenue of Rs 300 cr. The reason for this expansion is the increase in demand for the acetic anhydride in US & Europe. Acetic anhydride is used in the pharmaceutical industry as raw material in aspirin, paracetamol, sulfa drugs and in certain vitamins and hormones. Increase in demand for drugs, like aspirin and paracetamol has significantly benefitted the market for acetic anhydride.

INEOS and Celanese corporation are the two biggest global players in the acetyl market. INEOS has recently acquired all of BP’s Asia Pacific Petrochemical output for $5 billion which includes acetic acid production volume of 2.37million tn/yr. Celanese also has acetic acid capacity of 1.95 million tn/yr, and is the largest producer of Vinyl acetate monomer. These companies are Jubilant’s competitors globally. Domestically in ethyl acetate, Jubilant competes with IOL Chemicals, who have a capacity of 87,000 tn/yr. Jubilant at its Nira plant alone has the capacity to produce 100,000+ tn/yr of ethyl acetate, 29,000 tn/yr of CO2, 16,000 tn/yr of Vinyl acetate monomer , in addition to the 60,000tn + ton of acetic anhydride capacity (source). The company has spent money in recent years on removing the bottlenecks in the existing plants as well as increasing capacity of products in which they see demand in the new plant in Bharuch, Gujarat.

The Life Science Chemical revenues have a strong correlation to crude prices, as seen in the chart below. In the initial years, Jubilant was able to grow despite falling crude prices, due to a low base, increasing the capacity utilisation of their plants but once the volumes peaked, they have followed crude prices closely.

Due to the intense competition and limited margins in the acetyl market, Jubilant and the other large scale companies have vertically integrated their production to derive maximum benefits from the by-products in the manufacturing processes.

As seen above the acetaldehyde and formaldehyde produced as by-products from the Life science chemical business is used to produce pyridine and their derivative products, hence moving into higher value added products.

Specialty Intermediates- The speciality intermediate business produces pyridines, picolines, cyanopyridine and their value added derivatives. Jubilant setup its first pyridine and picoline factory in 1990, with capacity of 500 tn/yr. The company has since expanded their production and expertise in this sector multi-fold, current capacity stands in excess of 50,000 tn/yr for pyridine and its derivatives. Jubilant considers itself to among the Top 2 in this sector.

Pyridine and its derivatives find their application in agrochemicals, pharmaceutical, healthcare & nutrition and various other industries. Asia pacific region is the hub for pyridines, with China being the largest consumer and producer of pyridines in the world, accounting for more than 50% of the market. Agrochemicals accounts for more than half the consumption of pyridines, with majority being for production of the herbicide paraquat. The second largest use for pyridine is for production of beta-picoline, which is used for the production of Niacin (Vitamin B3).

China is the largest producer of paraquat in the world, accounting for almost 80% of the production. In 2012, China imposed a ban on the use and sales of liquid paraquat in China ( still could be exported) from 2016, and then in 2017, banned the sales and use of any paraquat formulation from 2020. In November 2013, the Ministry of Commerce of China imposed an anti-dumping duty on the import of pyridines from India and Japan, and imposed a duty of 24.6% on Jubilant. They reduced that to 17.6% in 2016, after Jubilant requested a review of the duty imposed. This severely affected the sales of Jubilant’s pyridine business, from which it still has not recovered. The sales of the Specialty intermediates is down almost 16% from FY14 to FY20.

The MoC of China announced in November 2019, that they will be withdrawing all anti-dumping duties imposed on import of pyridines from India and Japan. This should help Jubilant be more competitive in the Chinese market, where the sales of the company have been in decline since FY 14. The company operates in China through its subsidiary -Jubilant Life Sciences (Shanghai) Limited, whose revenues have declined from Rs 452cr in 2014 to Rs 179cr in 2020.

Jubilant has managed to stop the downslide in revenues of Speciality intermediates by reducing the dependence on one product ( paraquat) and doing some capex on retro fitting existing product specific pyridine plants into multi-purpose plants. The company retrofitted their Bharuch plant, where they produce Symtet ( another pyridine derivative), to produce gamma and beta picolines. These two products has seen good demand from pharmaceutical companies as gamma picolines( or 4-Cyanopyridine) is mainly used in Anti-tuberculosis drugs , and beta picoline is used as feedstock for Vitamin B3, also used in animal feed and healthcare industries. Jubilant has also started supplying two products in Oil & Gas Industry, these products are used as corrosion inhibitors and clay stabilisers. A new GMP multipurpose plant for pharma intermediates and a multipurpose plant for agro chemical intermediates was commissioned in FY19. Additionally, another facility has been setup for fluorinated derivatives.

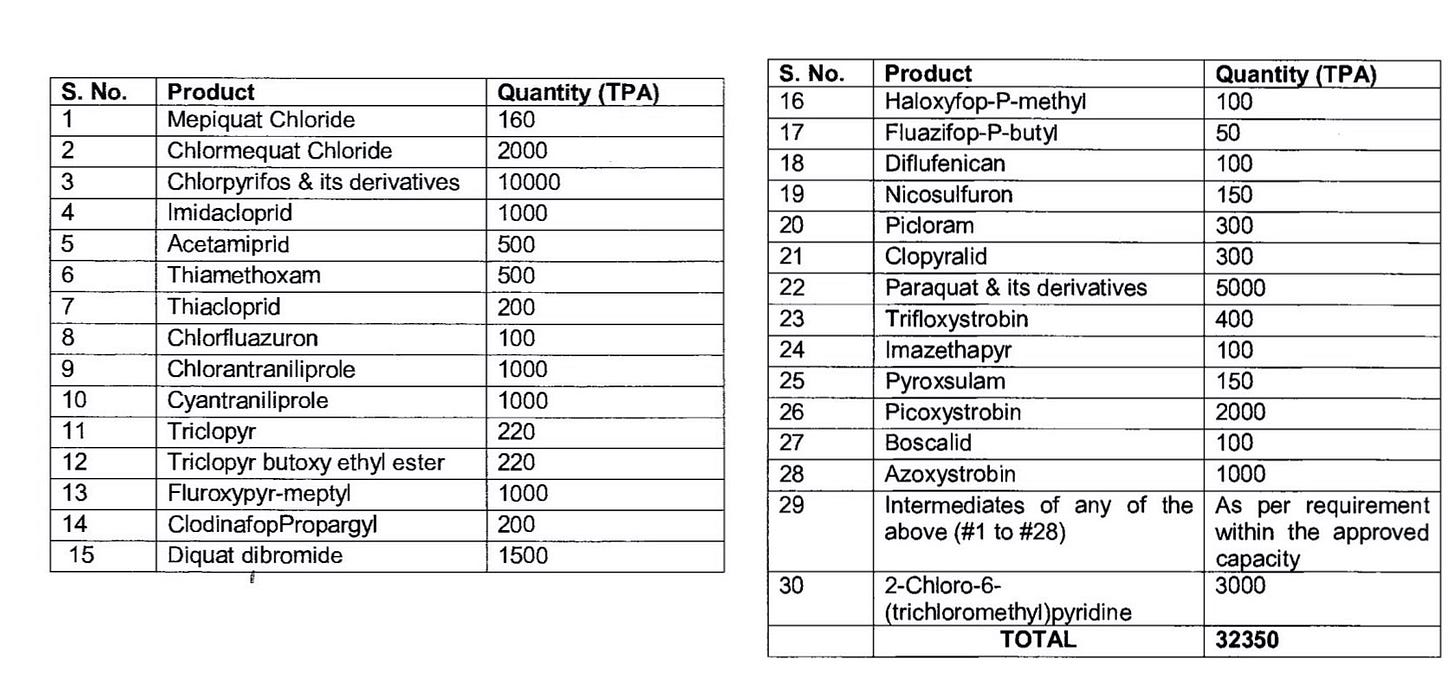

The major competitors for Jubilant globally would be Vertellus Specialities & Red Sun Group. Together, these three companies account for more than 50% of the pyridine market. Jubilant should be able to benefit from the “China +1” strategy, competition from Chinese players has been intense in this segment, as customers look to diversify their suppliers. Jubilant aims to launch a couple of new products every year, and reduce dependence on paraquat. Jubilant has an extensive list of crops science ingredients they can produce through pyridines, which includes chlorpyrifos, diquat bromide ( a substitute for paraquat) and many more. Jubilant has a capacity of 32,350 tn/yr at their Bharuch plant, to produce technical grade pesticides and intermediates. (Source). Chlorpyrifos and derivatives have approved capacity of 10,000 tn/yr, but the recent ban in EU and California, could mean a change in strategy for Jubilant yet again.

The company will further benefit from their forward integration into nutrition segment, which has pyridine derivatives ( 3- cyanopyridine and beta picoline) as key ingredients.

Nutritional Products- Jubilant’s key product in the nutrition segment is Vitamin B3. The company set up a 10,000 tn/yr niacinamide and 3-cyanopyridine plant at SEZ facility in Bharuch, Gujarat. This made Jubilant the largest producer of Vitamin B3 in India and the second largest globally.

Vitamin B3 is extensively used for Animal Nutrition- for poultry, dairy, swine and cattle, pet food, veterinary drugs and aqua feed. It is also used in Human Nutrition through dietary food supplements, in breakfast cereals, foods and beverages, infant formulas and so on. It also finds use in cosmetics, in skin creams and hair lotions and also in pharmaceuticals through multi-vitamin tablets and niacin treatment for diabetes and high cholesterol levels.

The global niacin market is lead by Chinese producers accounting for almost half of worldwide production, followed by India at around a quarter of the world’s total production. The largest competitor for Jubilant in this market would be Lonza Group, which has large production capacities all over the world ( including in China). According to Jubilant, the Vitamin B3 market capacity far exceeds the demand. This leads to downward pressure on Vitamin B3 prices. However, these capacities are restricted by lack availability of critical raw material - Beta picoline. Jubilant is one the largest producer of beta picoline in the world. Thus, backward integrated companies like Jubilant , benefit from availability of raw material and lower cost of production due to vertical integration. Despite this business advantage, Vitamin B3 is a commoditised product and the fluctuations in prices affect Jubilant’s sales.

The enhanced capacities from the Bharuch plant, post commissioning in 2013, lead to impressive growth in the nutrition ingredients revenue from FY13 to FY15. Post FY15, changes in prices of Vitamins have lead to significant fluctuation in revenues for the segment. Vitamin prices were at their highest in FY18, leading to higher revenues, but the prices then fell by 30-40% in FY19, leading to much lower revenues, before recovering in FY20. Jubilant has pointed out that they are seeing improved demand for Vitamin B3, due to covid related consumer shift, as well as customers looking for suppliers not dependent on China.

Vitamin and related nutrition products are the final products in Jubilant’s vertical integrated plants. Jubilant is now focussing on enhancing their foot print in Vitamin B3’s market application in dietary supplements and personal care products. In 2017, Jubilant entered into a strategic partnership with Barentz International, an international leader in the distribution of high-quality ingredients in Foods & Nutrition and personal care industries. The two companies would focus on “delivering solutions in food nutrition and fortification, in India and its neighbouring countries”. In 2018, Jubilant received World Health Organisation’s (WHO) Good Manufacturing Practice (GMP) certification for their Vitamins facility, which will help them increase their footprint in the premium food, personal care and other value added applications. These would be higher margin products, and reduce the dependence on Vitamin B3 prices. Jubilant is also widening their reach in Animal Nutrition products, and have recently launched a couple of 100% herbal products as well.

Over the last five years, the LSI margins have tracked their Nutritional Ingredient sales closely. Hence they have large dependence on the nutrition segment to improve their overall business margins.

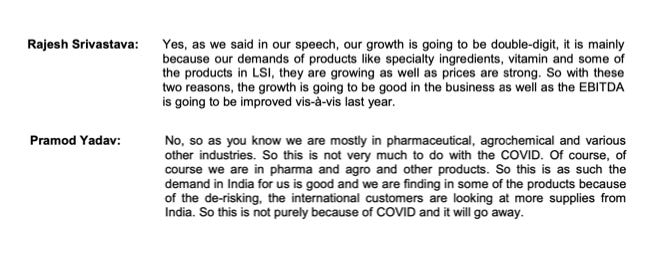

Jubilant’s management has indicated in a recent call, that they expect double digit growth in the LSI segment revenues, backed by strong pricing trend and improved demand for their products.

Almost 70% of the revenues in the LSI segment comes from Pharmaceuticals, Agrochemicals & Nutritional Products industries. Since these are essential industries, the impact from Covid-19 on their performance should be minimal.

The LSI revenue is concentrated mostly in the India, accounting for 60% of the revenues in FY20. Jubilant has been to unable to increase revenues in Developed markets, with overall revenue in EU,North America & Japan falling from around Rs 1000cr in FY15 to about Rs 850cr in FY20.

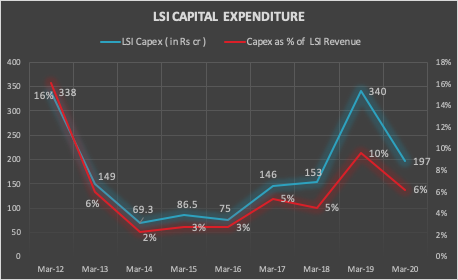

Jubilant has in the last few years increased the capex in the LSI business, to recover from the China set back. Going forward the capex spend should ideally come down.

Jubilant Life Science Ingredients business has taken a long term loan of Rs 745cr with staggered payment from March 2021, this was to redeem NCDs (worth Rs 745cr) expiring in 2022, the interest rate on these loans range from 6.25% to 8.75% .

The LSI business has also taken loan worth Rs 599cr from related parties ( mainly from Jubilant Infrastructure of Rs 274cr and Jubilant Generics of Rs 325cr ). The company has cash and equivalent of around Rs 258 cr.

The LSI business has generated operating cash of around Rs 1640cr in the last five years, averaging Rs 328cr a year. The operating cash flow has oscillated from Rs 560cr in FY18 to Rs 182 cr in FY19, and back to Rs 317cr in FY20. With capex in the last three years of Rs 690cr to increase revenue, the cash generation should ideally improve in the coming years.

With Jubilant Life Sciences de-merging into two separate entities, the LSI business will not have the support of the stable cash generating pharmaceutical company. The LSI segment had increased debt in the last couple of years for increased capex. The improved near term outlook, on margins and cash generation, means the LSI business can reduce the debt going forward from internal accruals, given there is no major capex plans.

The LSI business is much more volatile than the pharmaceutical business. It is hence important for the company to have lower liabilities, to be on stronger grounding when there is a business downturn in the future.

The company’s ROCE has declined with increased investment in new plants and products, going forward, one should expect the ROCE to rise in the near term, as the new plants come online and products are commercialised.

The Life Science Ingredient business overall, has products that are not going to be out of date, anytime soon. Jubilant’s biggest advantage in the LSI business is their scale and integration, the acetyl products still contribute the most to their top line, but the revenues are sensitive to prices of crude. If the management is able to scale their fine chemical and nutrition business, they should see lower volatility in earnings and margins in the future.

Hi!

If you liked the above letter, consider subscribing to my newsletter , and follow us on twitter. We will be posting one such deep dive every month. Do leave a comment and let us know what you think!!

Thanks for reading!!