Hi fellow investor,

( Disclosure: I own shares of Mahindra CIE Ltd and hence my views maybe biased. Everything I conclude in the article is solely my opinion, based on publicly available information. This should not be taken as financial advice. This is purely for educational purpose.)

Let’s get straight into it.

Short History, to start with!

Mahindra CIE Ltd was formed in 2014, after an alliance was structured in between CIE Automotive Ltd and Mahindra & Mahindra Ltd. In the deal, CIE bought shareholding stakes in Mahindra ancillary companies ( Mahindra Forgings, Mahindra Hinoday and Mahindra Composites), and these ancillary companies ( and some others) were merged into Mahindra Forging, which was renamed Mahindra CIE (MCIE). CIE also merged its European forging companies into MCIE. Mahindra, in exchange, bought a 13.8% stake in CIE Automotive, becoming its second largest shareholder. In the final entity (MCIE), CIE had a 53% stake (now increased to 60%) and M&M had 20% stake (now down to 11%).

This alliance was seen as a win-win for both CIE and M&M. M&M got a major European player in the automobile space as a partner, with ability to turnaround its flailing European operations as well as its technology and operational might, and on the other hand CIE got to enter the South Asia market.

Current Structure-

MCIE has 31 manufacturing facilities including 8 manufacturing facilities in Europe and 1 in Mexico. In India, the standalone entity supplies components to the light vehicles segment, two wheelers, tractors, medium and heavy commercial vehicles. MCIE has 4 major subsidiaries-

CIE Galfor- Situated in Spain, Galfor produces parts and components through forgings for the passenger vehicle industry. It is also the holding entity for MCIE in Europe and houses the other European businesses-

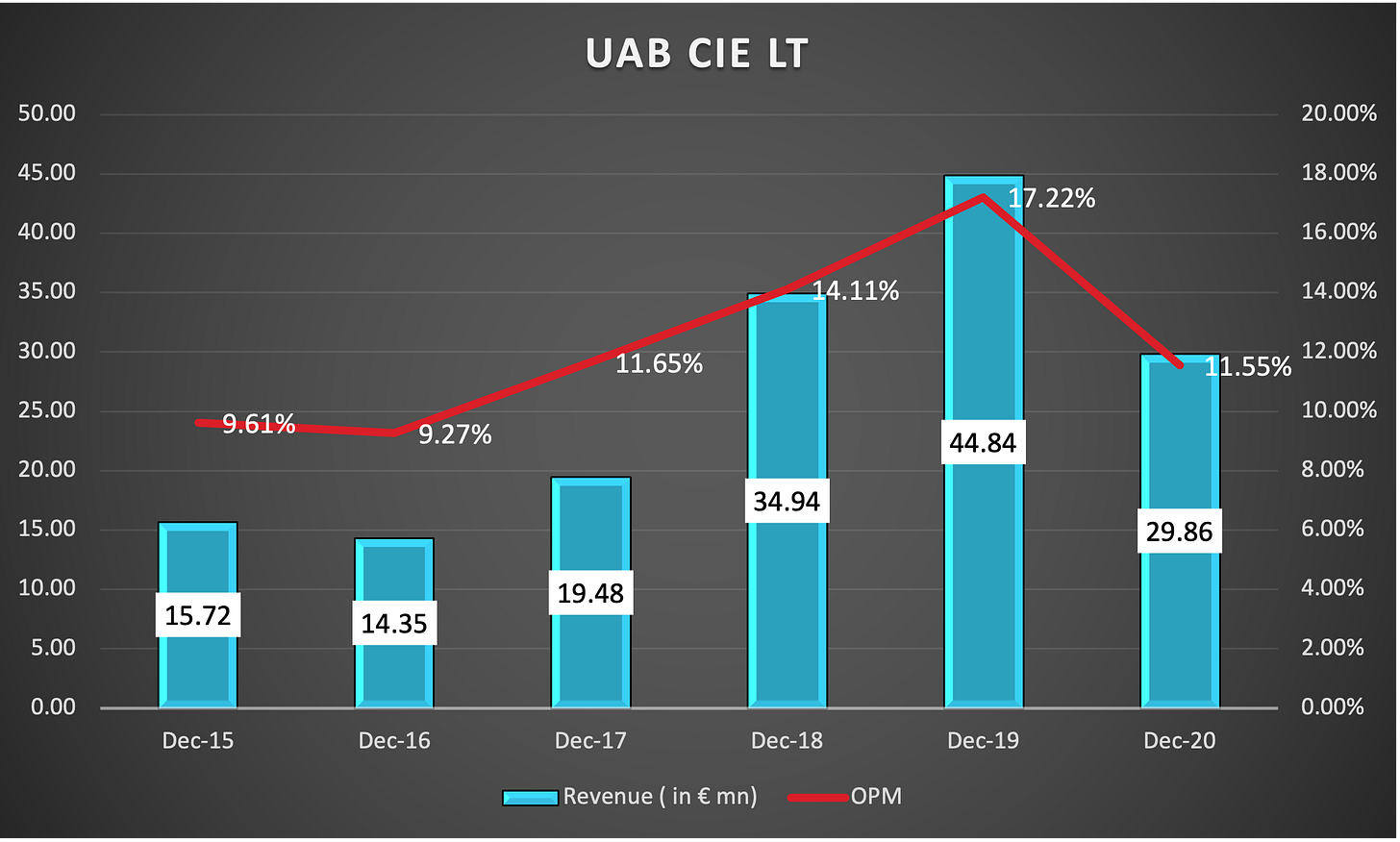

UAB CIE LT- Situated in Lithuania, producing crankshafts for the passenger vehicle industry.

CIE Legazpi- Situated in Spain, producing pressed and forged transmission components for the passenger vehicle industry.

Mahindra Forging Europe (MFE)- situated in Germany, has 3 plants producing drop forged components like axle beams for M&HCV industry.

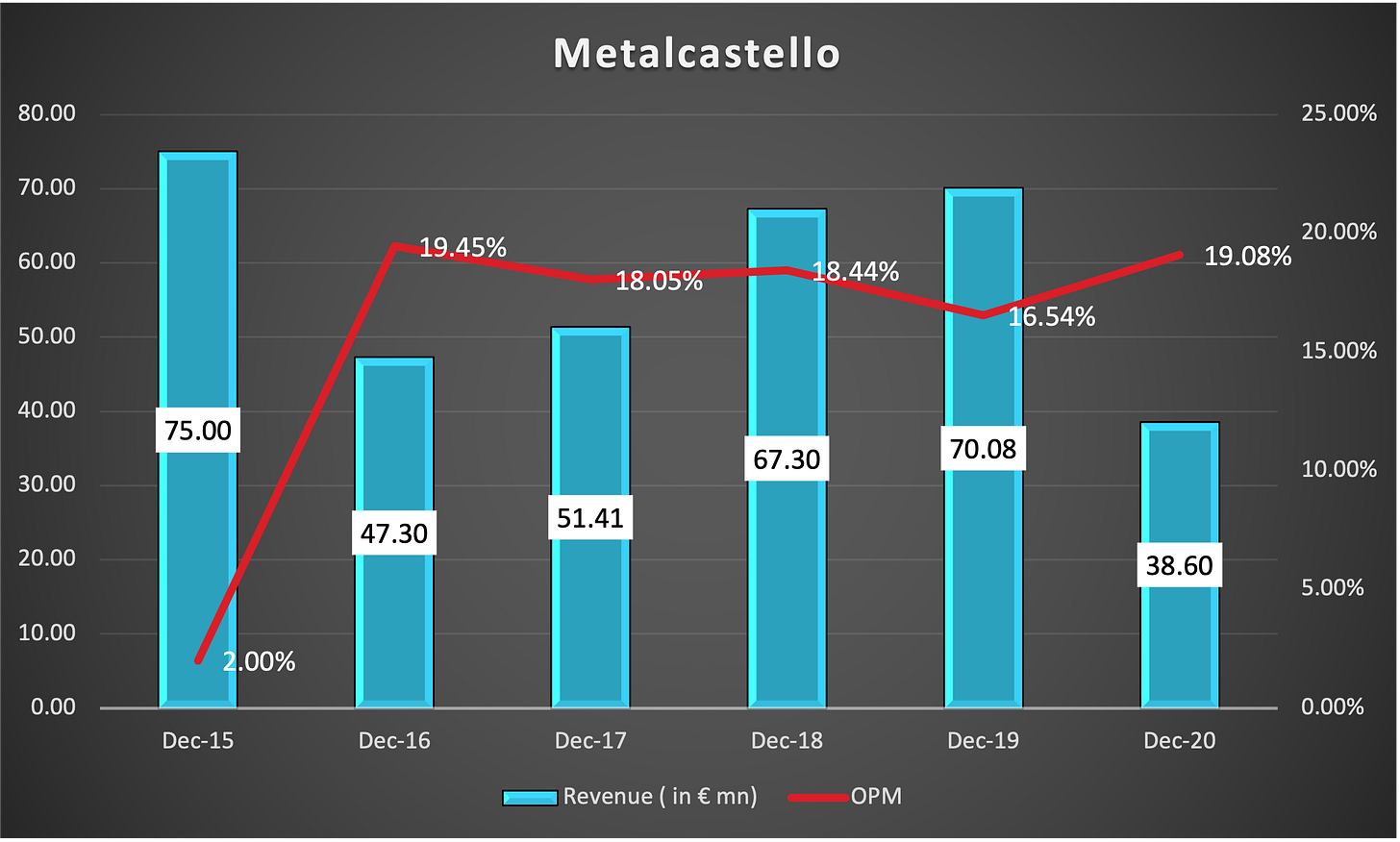

Metalcastello- Situated in Italy, produces gears and shafts for the off highway vehicle segment (Tractors, Earthmoving Equipments etc.)

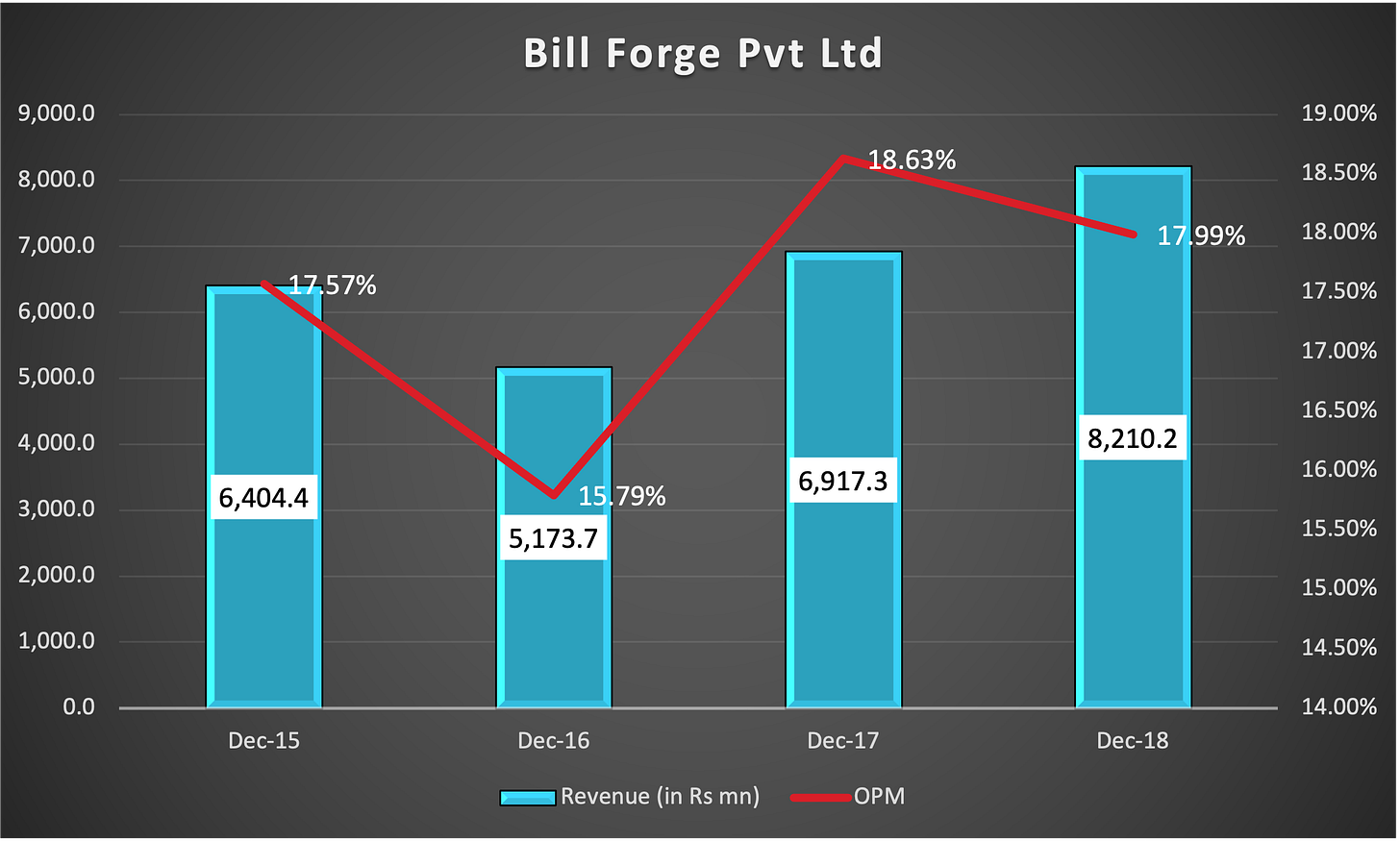

Bill Forge Precision Pvt Ltd- This is a small entity located in Coimbatore, supplying precision machinery and components to Hero Motors. The entity was acquired along with the parent- Bill Forge Pvt Ltd in 2016, but Bill Forge was amalgamated into the standalone entity in 2018.

Bill Forge de Mexico- This entity was setup in Mexico, in 2017. It has an automated machining plant to supply forged and machined components. It was setup to supply components for the Ford F 150 trucks to GKN Driveline. It has 2 big projects from GKN Driveline and Nexteer Automotive.

Aurangabad Electrical Ltd (AEL)- MCIE acquired AEL in 2019, for INR 8,759 million. AEL is in the business of manufacturing automobile brake system components which includes aluminium die casting components.

While, MCIE India (including BF Precision, BF Mexico & AEL) is more diversified across different segments like Forging, Stampings, Magnetics, Castings, etc., the European operations (MCIE Europe) is more concentrated into Forging (for light and heavy vehicles) and a small part into Gears.

MCIE India- Forging continues to be the major business for Mahindra CIE in India, with its first plant located in Chakan, Pune. The company supplies forged and machined- crankshafts and stub axles to M&M, Tata and Maruti through this facility. In 2016, MCIE acquired Bill Forge for an estimated Rs 13.03 bn. Bill Forge manufactures forged and machined components like spring valve retainers, steering races, gear blanks, shafts, etc. for 4W and 2W OEMs in India and abroad. Bill Forge has 11 plants spread across Haridwar, Hosur, and Jigani. Bill Forge was amalgamated into MCIE in 2018, as MCIE looked to optimise their forging facilities across India. MCIE has also focussed on increasing automation at their plants, and also increased capacity at their Chakan facility through a new robotised line, in 2018. With the forging facilities operating at near capacity, MCIE has decided to set up a greenfield unit in Hosur to take advantage of the “emerging growth opportunities”. The unit will be in a new subsidiary, as MCIE wants to take advantage of the GoI’s new schemes offering lower taxes.

BF Mexico was inaugurated in 2017, to supply components to GKN (for Ford F-150 trucks). The capacity expansion at the Mexico facility went through some operational struggles and the company aims to reach full capacity in 1-2 yrs time. The company broke even in 2020 and expects to reach a run rate of around €30-€40 mn (700mn-900mn pesos) at full capacity, and achieve similar margins (around 18%) to the Indian forging facilities. The company has two big orders from GKN Driveline and Nexteer Automotive.

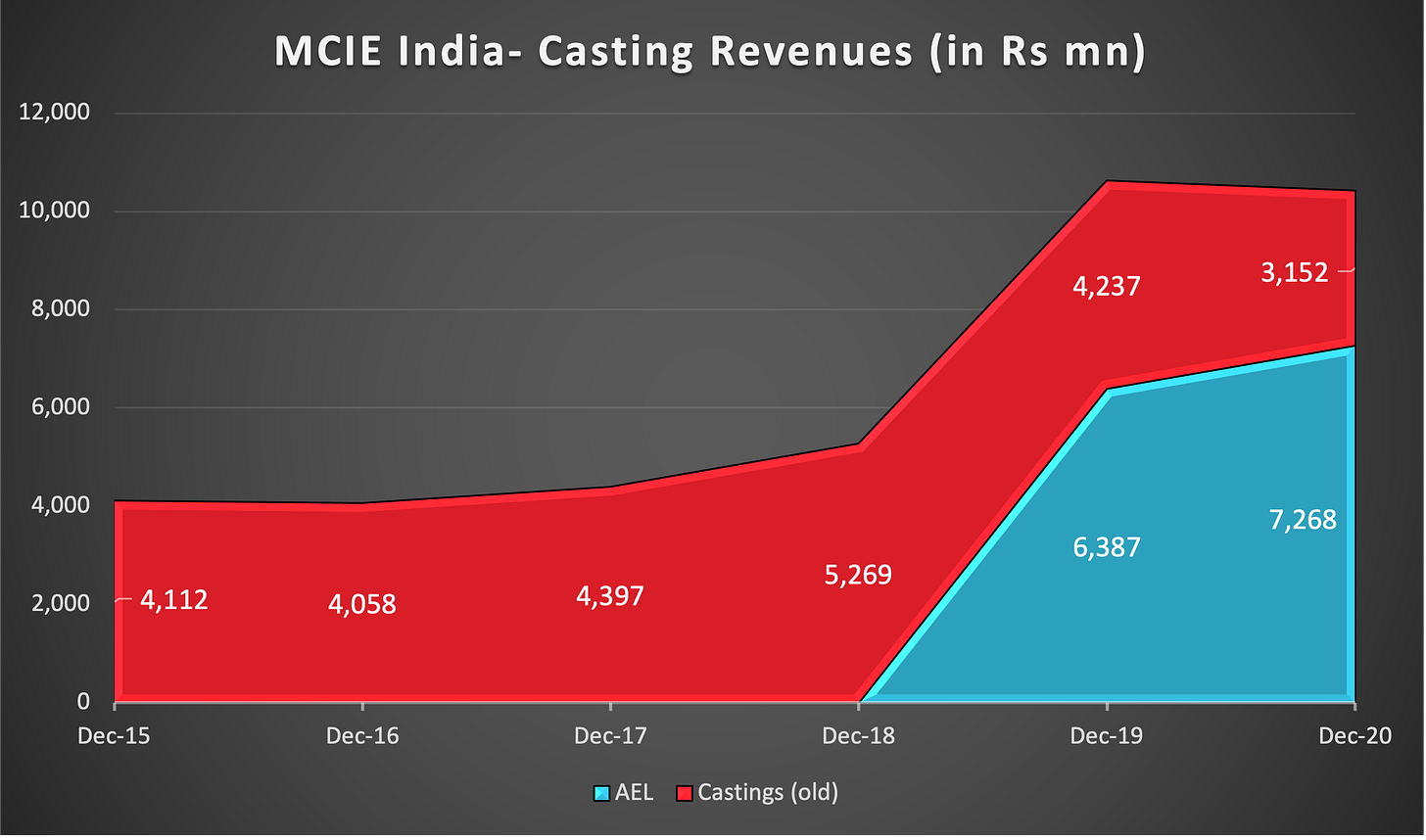

MCIE India also had a relatively small ‘Casting’ business, prior to the AEL acquisition, with one plant in Pune. They provided iron casting products like turbocharger housing and transmission parts to mainly Tier 1 suppliers like AutoAxle, Honeywell, as well as M&M among others. The acquisition of AEL, filled a major gap in their product portfolio, adding Aluminium High Pressure (HPDC) and Gravity Die Casting (GDC). AEL is expanding its GDC capacity, which currently accounts for 15% of its sales (85% from HPDC), and expects to see good exports to Europe from this facility. Bajaj Auto is their main customer, accounting for approx. 70% of its sales. AEL had a run rate of around Rs 8500 mn, prior to acquisition and the new GDC capacity should help take that number further up and improve margins as well, as it has higher margins (around 15%) compared to HPDC.

Stamping is another business which MCIE has spent considerable amount in expanding in the last few years. MCIE has 5 plants, with total capacity of 185k tonnes. They provide chassis, front panel and skin panel parts to M&M and Tata. The new fully automated facility at Zaheerabad, has been built to expand revenues beyond M&M ( which accounts for 85% of revenues in this segment) to European and Korean car makers. While Stamping has lower margins compared to MCIE India overall, the automated facility will have better margins due to higher productivity and lower defects.

Gears India was amalgamated into MCIE in 2017. The company produces transmission and engine gears for cars, tractors, earthmoving equipments, etc. MCIE has benefitted from having a gear company in India and in Italy (Metalcastello), as they have been to able to continue supplying to customers, wanting to shift their production from Europe to India, like in the case of Caterpillar in 2017. MCIE has also modernised the plant in India with technology transfer from the European entity.

Magnetics & Composites are really small part of MCIE India’s total revenues . In the Composites business, company makes sheet/dough molding compounds used in making the front lid, bumper, fuel tank, etc. for PVs and CVs. The Magnetic division produces soft and hard magnets used in motors, MCIE is looking to expand to higher grades and moving up the value chain.

MCIE India as a whole is well diversified across different vehicle & product segments. M&M, Tata and Maruti continue to be their top 3 customers, and account for more than 50% of their sales ( if one includes indirect sales through Tier 1 suppliers). Merger with CIE has allowed the company to improve profitability at their Indian plants, through technology transfer, higher automation and better operational processes. MCIE India makes 87% of their sales from Passenger vehicles (40%), 2Ws (32%) and Tractors (16%). So it’s no surprise to see their revenues decline (not counting in the AEL Acquisition in 2019) in the last three years as the production numbers have come down in those segments.

MCIE Europe- The European automobile industry is a saturated industry with limited growth visibility. The M&HCV (>6 tonnes vehicles) segment has been in turmoil post the 2009 crisis, and the production numbers have been in decline since 2016. The forging business that CIE merged into MCIE, mostly supplies to passenger vehicle segment which has been more or less stable in the last five years with some decline in last three years as well.

UAB CIE LT Forge, the Lithuanian company, has seen impressive growth, way above the industry growth rates, in the last five years, with new crankshaft machining lines and orders from German PV OEMs like VW. The increased automation and utilisation has lead to better margins as well.

CIE Legazpi and CIE Galfor, have been stable and moved with the industry growth rates. While in CIE Legazpi, the lower utilisation has lead to lower margins as well, in CIE Galfor, the margins have been inline with CIE targets and among the highest in group companies. The margins and the revenues are expected to come back, as the industry responds post covid.

Metalcastello, the Italian gear manufacturer, was restructured 2014, CIE reduced the manpower and rationalised the product portfolio. The company got a major order from Caterpillar in 2018. The plant was fully booked in 2018 and MCIE had to look to expand capacity to meet demand. The company has seen impressive revenue growth and margins, and the same is expected to return in next 1-1.5yrs. Currently, the company is fully booked and adding additional capacity.

Mahindra Forging Europe AG (MFE), was also in need of restructuring, prior to the Mahindra CIE alliance. MCIE decided to close the plant in Jeco, and move the production to remaining 3 plants in Germany. In 2018, CIE also injected €25mn into the company to help it repay some inter company loans. MFE is dependent on the MHCV industry and makes 2/3rds of its revenue from 5 customers, largest being Daimler. The restructuring and increased demand from North America, helped the company turn profitable but that didn’t last long. MCIE took the opportunity during Covid, to permanently downsize the operations of the company and reduce the break even level. Going forward the management expects the results to be stable but the nature of their products will not allow it to reach MCIE group margins.

With the restructuring at MFE, MCIE Europe revenues will probably be lower in the next few years, but the profitability is expected to be better, as the other entities get back to previous run rates.

Peer Comparison-

The comparison does show that MCIE has lower margin than peers mostly due to higher employee cost. The restructuring at MFE and better utilisation should help reduce the employee expenses going forward.

The “CIE Group target” is to achieve margins of 18% and Return on Net Assets (RONA) of 20%, across all their companies. The MCIE management has indicated they are trying to achieve the same here as well. The company had improved its capital usage- reducing debt and improved returns to net assets, prior to the slowdown in the underlying industry.

Outlook-

EV Disruption- The biggest story in the automotive sector currently is Electric vehicles (EVs). Companies with an EV presence are seeing a premium being attached to their valuations as well. MCIE doesn’t fall into that category. MCIE expects about a third of its revenues in MCIE Europe and around a quarter of their revenues in MCIE India being affected by a “complete” shift to Battery operated Electric Vehicles(BEVs). Most of this fall will be in forged components like crankshafts, which won’t find space in BEVs (no engines!). The management though doesn't expect this to happen anytime soon. According to the current projections- Europe expects to see 15% penetration of EVs in new vehicle registrations from 2025, which would come to around 5% drop in revenues, as things stand now.

MCIE Strategy- However, this doesn’t mean that the company isn’t working closely with the major OEMs on this eventual transition. The management expects to see a shift towards aluminium forgings (due to weight reduction), and will be able to use the current presses and facilities with slight line modifications and additions like treatment ovens. Company believes that weight bearing parts like suspension and chassis will still require forged rather than casting components. EVs will also see more demand for stampings, plastics and magnetic products, all of which MCIE has in its arsenal. In 2020, MCIE’s Gear plant (Metalcastello) also got an order from an American OEM for shafts and gears to be used in an electric powertrain, and MCIE’s parent CIE Automotive is already supplying components for EVs to OEMs like Tesla and Renault. The management thinks the companies quite well placed in India and Europe to deal with the eventual shift to EVs.

Near term Outlook- In the present, the management’s focus is on increasing their market share with OEMs in all their existing products. In Europe, except MFE, the management expects the revenues to return in all the other entities in the next couple of years to 2018 levels and the restructuring done during covid should help in improving margins as well. Though being a mature market, don’t expect any major growth in the European market.

Thus, major focus is on the Indian market. The management and the parent CIE, is quite bullish on the prospects of growth in India and are looking at India, as a manufacturing and export hub. MCIE has been making all its growth capital expenditures in India, and are aggressively looking to add customers. The company will spend 5-6% of its Sales on growth capex, and is looking to grow organically and inorganically. The acquisition strategy is to be on par with the parent on technology and the only thing missing from its product portfolio is “plastic components”.

The company expects to grow more than the underlying industry in India, due to additional capacity coming up, and inorganic additions. The growth in the underlying industry though, has been quite unpredictable, with vehicle sales suffering from multiple disruptions since 2018 - BSVI, Covid and, now higher fuel prices and semiconductor shortages. The management expects the shortages to ease up in the next few quarters and are looking at strong growth from CY2022 onwards. The higher margins seen in the first half of the year (about 14%+) are expected to be sustainable (the company passes on any raw material price increases), with the management aiming to reach “CIE Target” no.s in the coming years.

Hi!

If you liked the above letter, consider subscribing to our newsletter. We have covered a number of other companies- Endurance, Phoenix Mills, Jubilant Pharmova, Ingrevia, among others. You can check those out here- We will be posting one such article every month. See you soon!!

Thanks for reading!!

You can also find us on Twitter.