Hi fellow investor,

( Disclosure: I own shares of Redington India Ltd and hence my views on the topic may be biased. Everything I conclude in the article is solely my opinion, based on publicly available information. This should not be taken as financial advice. This is purely for educational purpose.)

Let’s get straight into it.

Redington is known for being the one of the leading distributors of Apple devices in India, let’s take a deeper look into their business.

Redington India was founded by R. Srinivasan, an engineer and IIM Ahmedabad alumnus. Mr Srinivasan moved to Singapore, and began importing and selling printers. That was the beginning of Redington. When Mr Srinivasan moved back to India in the mid-’90s, he brought Redington and the printers business with him. Redington started business in Dubai in 1997, distributing computing devices and networking products. Synnex Corp, one of the largest IT distributors in the world, invested $24 million in 2005, for a 36.31 percent stake in the Redington Group. It was a strategic alliance, with Synnex enhancing their reach in India, in exchange for improving Redington’s logistics management and enhancing the efficiency of its operation. Redington went public via an IPO in 2007, which was 43.27 times over subscribed.

Redington currently the 2nd largest technology product distributor in India ( behind Ingram Micro) and the largest IT distributor in Middle East, Turkey and Africa (META). Redington is a professionally run company since 2015. The founder divested all his stake in 2018. Synnex Corp and Affirma Capital (from StanChart PE) are the major shareholders, as of Dec’20.

Redington has three major business segments- IT, Mobility and Services.

IT comprises of enterprise products like PCs, peripherals, enterprise software & cloud solutions, storage and security solutions and high end servers.

Mobility consists of more consumer lifestyle products, like mobile phones, smartwatches, tablets, and gaming consoles.

Services include the Supply chain and logistics business under Pro-Connect, support services through Ensure Services.

Redington has four major subsidiaries,

Redington Gulf FZE (RGF)- Headquartered in Dubai, RGF controls the overseas distribution and services business of Redington India. RGF has a no. of subsidiaries spread across Africa & Middle-East.

Redington Distribution Pte. Ltd (RDPL) - Wholly owned subsidiary of Redington India, located in Singapore. Company imports and sells computers, peripherals and networking products in South Asia region- Sri Lanka, Bangladesh, Nepal and Maldives.

ProConnect Supply Chain Solutions Ltd- Wholly owned subsidiary of Redington India Ltd. Company provides warehousing, transportation and other value added logistical services in India.

Redington International Mauritius Ltd (RIML) - Its a holding company which owns 100% stake in Redington Gulf FZE. It was setup to raise funds for the overseas subsidiary (RGF), which being a Free Zone Establishment (FZE) could only have one owner. In 2009, Redington India transferred its holding in Redington Gulf to RIML. The company did this at no consideration. The Income tax department took the view that this couldn’t be done at no consideration and slapped Rs 1.38 bn tax on Redington India for violating transfer pricing norms. Redington India settled this dispute in Q3 FY21, and paid Rs 890 million, availing the “Vivaad Se Vishwas” scheme, after they lost the case in the Madras High Court last year.

Redington has managed to grow their revenues at a CAGR of 14% in the last decade, from Rs 137.5 billion in FY10 to Rs 514.7 billion in FY20. The growth has been lead by the Overseas business, which has grown revenue at around 16% per year to Rs 326.8 billion, while the Indian business has grown Revenue at 10% per year to Rs 187.9 billion in FY20.

Apple has contributed to a major part of this growth in the last decade. Apple accounted for only 1% of Redington’s revenue in FY11, which has grown to 29% in FY20. The fortunes are reversed in HP’s case, whose contribution to the top-line has decreased from 33% to 13% in the last decade. This shows the shift in technology spending from PCs towards mobiles and tablets. Dell EMC has seen impressive growth in the last four years, growing at 30% CAGR, the fastest among the top vendors for Redington. Dell EMC provides storage and server solutions for data centres, which has seen increased adoption in the last four years.

Redington Overseas-

The overseas revenue has grown at 10% per yr, in the last five years, and the growth has been led by the mobility segment.

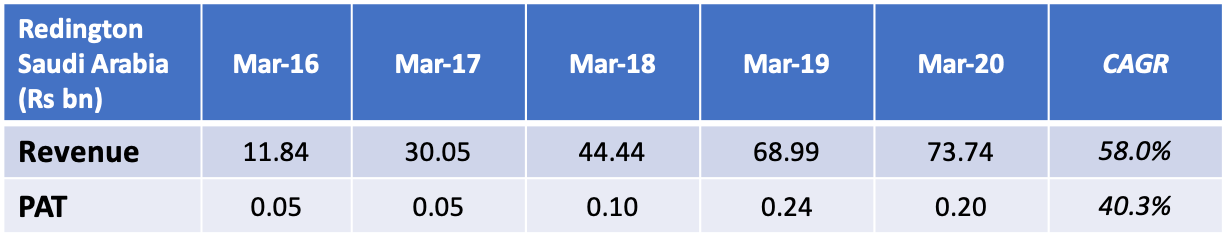

Within the Overseas segment, Saudi Arabia has contributed the most to the growth in revenues. Redington has grown its revenues in Saudi Arabia from Rs 11.84 bn in FY16 to Rs 73.74 bn in FY20. In FY17, Redington Saudi Arabia signed a distribution agreement for iPhones with Apple. Apart from Apple, RGF also has agreements in place with Samsung and Huawei, both have significant market shares in consumer and enterprise segments, in the META countries.

Redington has made majority of its revenues in the overseas segment in three countries- UAE, Saudi Arabia & Turkey. Turkey currently accounts for around 13% of Redington’s overseas revenue. Redington entered the Turkey market in 2010, when RGF acquired 49.4% stake in Arena for $42 mn, the 2nd largest IT distributor in Turkey. Arena has grown revenues from Rs 31.5bn in 2015 to Rs 36bn in 2020. Redington has had trouble in maintaining profitability in the Turkey business, due to currency fluctuations (Turkish Lira depreciation) and political uncertainty in the last five years. In FY19, Redington took an impairment of Rs 712 mn in Arena, due to currency devaluation and challenging business environment.

In FY16, RGF acquired Linkplus (now Redington Turkey) for $6.7mn. Linkplus is a distributor of enterprise technologies, like Oracle, Red Hat, Trend Micro, Splunk, and Versa Networks, in Turkey. They offer pre-sales and after-sales services like demo, training, periodic product maintenance and technical support.

Redington setup RDPL in Singapore to import IT products, and then export them to India and other South Asian countries. Vendors and customers preferred to sell/buy in Singapore in $ denomination, as duties and taxes were high in India, and they were able utilise lower overseas interest rates as well. In the last few years, the gap has narrowed, with duty harmonisation in India and vendors are providing the products directly in India. RDPL has thus started loosing some business, as it gets shifted to India directly. Redington will eventually merge RDPL into Redington India.

RGF has setup logistical facilities in Jeddah (in 2018) and Dubai (in 2011), they provide services like warehousing, freight forwarding, local distribution, and last mile delivery through its subsidiary ProConnect Logistics. ProConnect provides these services internally to RGF as well, and that accounts for around 60% of its revenues.

Apart from logistical services, Redington Gulf also provides support services in META countries through its subsidiary, Ensure Services. Ensure provides IT Infrastructure services, On-Demand Support services ( like hardware/software installation), electronic repairs, spare part distribution, etc. to both enterprise and retail customers.

With enterprise hardware business slowing down, Redington has been developing its software distribution business for the last five years, to move from a reseller of licenses to a solution partner.

RGF setup “Redington Value” in 2018, as a go-to-market solution for vendors. Redington aims to use their relationship with thousands of channel partners and understanding of the local market dynamics in the META region, to train the channel partners and help them provide customised solutions to their customers.

In line with this, Redington has setup “Red Vault”, a solution centre to showcase- private cloud and software defined networking solutions to potential end customers in the META region.

Redington also launched a unified cloud platform (“RedCloud”), that will offer partners and resellers a marketplace for all workloads and technologies across verticals. The RedCloud portal offers a single sign-in platform for all cloud services with a billing, provisioning, automation and online payment option. Redington has managed to add a bouquet of cloud services from AWS, Microsoft, RedHat, Oracle, IBM, etc. to the platform.

Redington setup Citrus Consulting in 2018, to provide niche services like cloud transformation, advanced analytics, big data management, data centre modernisation, etc. In FY20, Citrus recorded revenues of Rs 205 mn ( off which 60% was from RGF itself) and loss of Rs 47.6 mn.

Redington India-

The Indian operations tell a similar story to the overseas, with the mobility segment leading the way in the last five years.

Within the IT segment, storage and server solutions has seen increased demand in the last three years, due to investment by Data centre providers, who are seeing high demand for outsourced data centres. Traditional IT products like PCs and Laptops have seen demand flatten, with limited incentives for frequent replacements and upgrades.

Mobility segment has continued to grow for Redington. Redington and Ingram Micro are the only major distributors of Apple products in India. Redington also has distribution rights for Samsung, Xiaomi, One Plus & Xbox.

In the Services segment, Redington had three major businesses, similar to the overseas operations- post sale services like repair, maintenance and warranty services through Ensure, spare parts distribution, installation & implementation services through Cadensworth, and logistics services through ProConnect Logistics.

in FY16, Redington merged Cadensworth into Redington India, due to increased overlap in the businesses of the two entities. Redington sold Ensure Services India to Accel Ltd, in FY21 for Rs 310 million, as the company didn’t consider the business strategic to their future plans.

Redington India, hived off the the warehousing and logistics business into ProConnect India in 2012. ProConnect currently has 2 Automated Distribution Centres (in Chennai & Kolkata), over 170 warehouses and over 6 million sq. ft. space in India. They provide warehousing facilities, last mile delivery and other services to e-commerce, FMCG, pharmaceutical, IT & Telecom companies.

ProConnect India acquired 76% stake in Rajprotim Supply Chain Solutions (RCS) in FY17, (with the remaining 24% to be acquired on earn-out basis), to increase presence in Eastern and North Eastern part of India. Redington also acquired Auroma Logistics in FY19 ( for around Rs 400 mil), to increase presence in the consumer durables industry.

ProConnect has shown robust growth in Revenues since being setup as a separate entity and earns only 16% of its revenues internally. The large drop in profit in FY20 was due to impairments the company had to take in its subsidiary RCS ( red dotted line showing OPM excl. impairment).

ProConnect had given a loan of Rs 120 mn to Rajprotim Agencies (RAPAL), a major vendor of RCS, handling all of RCS’s transportation. RCS had trade advances outstanding of Rs 206.9 mn & receivables outstanding of Rs 119.3 mn, with RAPAL as of FY20. ProConnect had to take a provision of Rs 438.5 mn, as RAPAL defaulted in Q3’FY20. RCS was managed by the previous owner of the company (despite ProConnect holding the majority stake) and the owner’s other entity (RAPAL) was managing all the transportation for RCS. ProConnect had no personnel on the ground. ProConnect has replaced the full RCS team with new personnel, something they should have done in the first place. In the near future, RCS and Auroma will be merged into ProConnect. The company had secured the loan to RAPAL, through a land parcel (worth Rs 20 mn) and 89% shares of RAPAL, and are taking the necessary steps to recover the loan and the trade advance.

Peers-

Ingram Micro is Redington’s biggest competition in the Indian market. Redington and Ingram address the majority of the market ( around 70%) in India. Other regional players include Savex Technologies and Rashi Peripherals.

Ingram Micro, Avnet & Arrow Electronics are present in the Middle East & Africa, and have bought stakes in companies in Turkey as well. Local players like BDL Gulf and Arab Business Machine also compete with Redington in the Middle East region. Ingram Micro, Avnet and Arrow Technologies are much larger than Redington and pose a threat to Redington, if they enter into its market.

Business Model-

The Gross margins are higher for the IT vertical than for Mobility, as the enterprise projects are for longer time frame and the system integrators require longer credit periods to payback Redington.

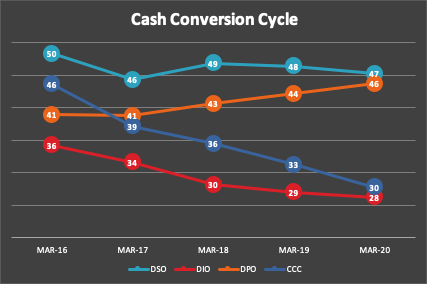

Redington is preferred by companies like Xiaomi, to increase offline sales, due to their reach, expertise in sales and marketing and low cost functioning. The value to the customer includes scale purchasing power, financing, and inventory management. Redington’s managed to keep receivable provisioning at 0.1% of Revenue and inventory provisioning at 0.04% of Revenue, for the last ten years. To meet dues during the year, Redington avails ST loans of 90 days or less, these have come down from Rs 305 bn in FY18 to Rs 227bn in FY20 but the interest cost has stayed at 0.4% of Revenue for the last three years. The lower working capital loan availed, is due to longer credit period that Redington has been able to get from the vendors and the quicker inventory turnover. Redington expects the Cash conversion cycle to remain in the 33-35 days range going forward and increase EBITDA with more contribution coming in from the services and enterprise segments.

Outlook-

India’s digital surge is currently being lead by the consumer segment. Smartphone penetration in India has reached around 40%, with online channels accounting for 45% of the smartphone sales. The adoption in the business sector hasn’t been this uniform, with the large companies, with extensive resources, adopting digital applications and adapting workflows, while smaller companies lead the way in accepting digital payments. India had more than 650 mn internet users in 2020, this will continue to increase with greater broadband & smartphone penetration in India. The growth in digital traffic and cloud adoption has lead to massive investments in data centres in India as well.

Redington’s domestic business has seen increased competition from e-commerce players in the PC, laptops, and mobility markets. Many brands now have direct partnership with e-commerce players or Large format retailers to market their products. The competitors are expanding their reach throughout the country, adding fulfilment centres at an increasing pace. Being one of the two only distributors of Apple in India, is a big advantage for Redington. In the first nine months of FY21, Apple products accounted for 32% of Redington’s sales. Redington supplies Apple products to both offline and online players in India. With Apple starting their own online store in FY21, Redington thinks it will lead to increase in demand for Apple products. Since retailers offer more discounts than Apple and in big ticket purchases customers prefer to buy from a store rather than online, Redington’s share will grow as well. Redington points to countries like UAE, where they have managed to maintain their market share in Apple, despite Apple having two stores and direct partnerships with large format retailers as well. The launch of Apple’s ARM based laptops has also been very well received and expected to see good sales. In Saudi Arabia and UAE, Apple has around 30% market share in smartphones, compared to 3% in India. Apple manufacturing iPhones in India and expanding their line up to lower price points are big positives as well. Apple has in the past looked at increasing distributors in India, but reverted back to a two distributor model. Any addition to the distributors will affect Redington negatively. As far as other vendors are concerned, Redington differentiates itself with its low cost model and reach in Tier 2 and 3 cities, but with the ever expanding reach of Amazon and Flipkart, that will continue to be under threat.

In the Enterprise segment, with enterprise PC sales slowing down, Redington has focussed on software solutions - Redington is providing cloud managed solutions, with channel partner to customers. Redington is a Cloud service provider for AWS, Azure, Oracle and IBM. Redington is a Tier 2 reseller, and helps Service providers like Microsoft or Amazon reach smaller businesses who can’t afford the services of an IT company. Redington has pointed towards building a "service model” that will lead to increase in annuity income, but insits its still 2-3 yrs away.

The investment going into data centres in India, will also lead to increase in demand for networking and storage equipment. Redington also started distributing health and medical equipments (HME) and solar equipments in FY18. Solar distribution business was hit by governments imposing duty on imported solar panels and Redington is currently reviewing their strategy there.

The challenge for Redington would be to grow without sacrificing profitability, given the increased competition. Redington has seen their ROE drop over the last ten years, even though the drop in the last three years could be attributed to Turkey, ProConnect and covid related issues. The company has started generating significant operating cash flows(OCF) in the last five years, averaging around Rs 6.8bn. This ties back to the improved Cash conversion cycle mentioned before. The increased cash, has been used to expand logistics business( bought RCS and Auroma) & increase software distribution business( acquired Linkplus). But the majority of cash generated has gone into the bank, leading to increase in Cash Balance from Rs 5.3bn in FY15 to Rs 23.8bn in FY20. This cash is presumably being used as working capital for the expanding distribution business, but the reduced profitability has lead to the ROCE falling in the last five years as well.

The first nine months results for FY21 have been excellent, with revenue increasing by 7% YoY, Operating profit up 18% YoY and PAT up 14% YoY. This is after Rs 890mn hit Redington took due to tax issue ( mentioned earlier). The OPM for 9M’FY21 was 2.22%, with the growth being lead by the Mobility segment. The enterprise segment has remained flat, despite growth in cloud and security solutions. Storage and networking solutions make up more than 50% of the IT Enterprise revenue, and the management expects this to grow with increased infrastructure spending in the sector. Redington has seen exceptional FCF generation in the last 9 months of Rs 27.61 bn, which is around 40% of its market cap, as of March’20 end. Redington had a negative net debt of Rs 25 bn at the end of Dec’20. The management expects to deploy this additional capital into the business as normalcy returns, and some portion will be kept for growth and acquisitions in the near term.

Hi!

If you liked the above letter, consider subscribing to our newsletter and follow us on twitter. We will be posting one such article every month. See you soon!!

Thanks for reading!!