Hi fellow investor,

( Disclosure: I own shares of RBA and hence my views maybe biased. Everything I conclude in the article is solely my opinion, based on publicly available information. This should not be taken as financial advice. This is purely for educational purpose.)

Let’s get straight into it.

Short background, to start with!

Restaurant Brand Asia (“RBA”) holds the national master franchise for Burger King in India and Indonesia till 2039, as well as Popeye’s in Indonesia. QSR Asia Pte Ltd holds 15.47% stake in RBA (as of Sept 23). QSR Asia was incorporated in 2013, and opened the first Burger King outlet in India, in November 2014. As of June 2023, RBA has 396 Burger King Outlets in India, as well as 169 outlets of Burger King and 10 Popeye’s, in Indonesia.

F&B Singapore (“Everstone Capital”) owns 86.93% and Burger King Asia Pacific owns 11% of QSR Asia Pte Ltd, respectively. Everstone Capital is a PE fund with multiple business interests including credit, real estate, and the fast food industry. The PE fund has under its control various fast food brands like Harry’s in Singapore, Domino’s in Indonesia, Pind Balluchi, Blue Foods and Burger King in India. The fund typically has an average holding period of 7 years, after which they look to divest their stake. QSR Asia partially divested its stake in RBA, via an IPO, in December 2020. QSR further sold 25% of its stake in RBA, through open market in Sept 23 (more on this later).

According to the Master Franchise & Development Agreement (MFDA) signed with Restaurant Brand International Inc (parent of Burger King Corporation), RBA needs to open at least 700 restaurants by December 2026. The management says the target was set after mutual discussion with Burger King, and comprehensive total addressable market surveys. They also point out that they won’t be stopping at the 700 mark, as the food services industry in India will continue to grow in the years to come.

India’s per capita spend on Food Services is one of the lowest among the emerging economies.

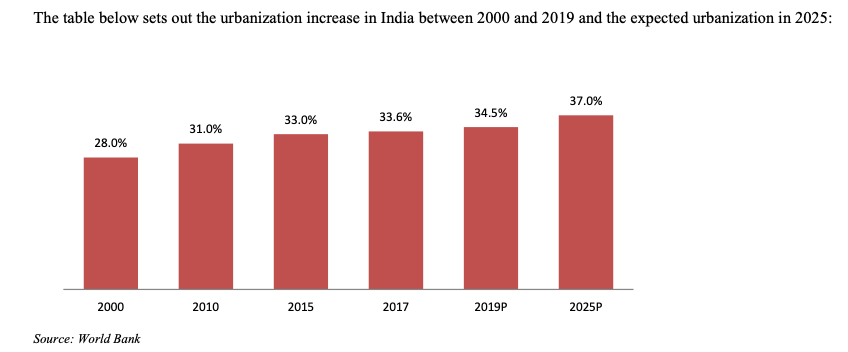

India also has the second largest urban population in the world, at 472 million, second only to China. This number is only going to increase with rising urban development in the country.

The management in an earnings call also explained - In Indonesia, the urban population eats out 17 times a month, so every alternative day, compared to 28 times in China. In India, the urban population eats out 6 times in a month. So Indians are still going out to eat only on weekends.

The Indian food services industry should continue to grow, as the rising urbanization, increasing per capita income and a large young working age population leads to a change in the Indian eating out habits.

The story for Indonesia isn’t much different, with 68% of the population in the working age (15-64) in 2020 (World Bank), which is around 180 million people. While per capita spend on food services is more than in India (see table above), it still has room to grow, with low penetration of organized players in the food market (6% penetration for chain QSRs).

Burger King India

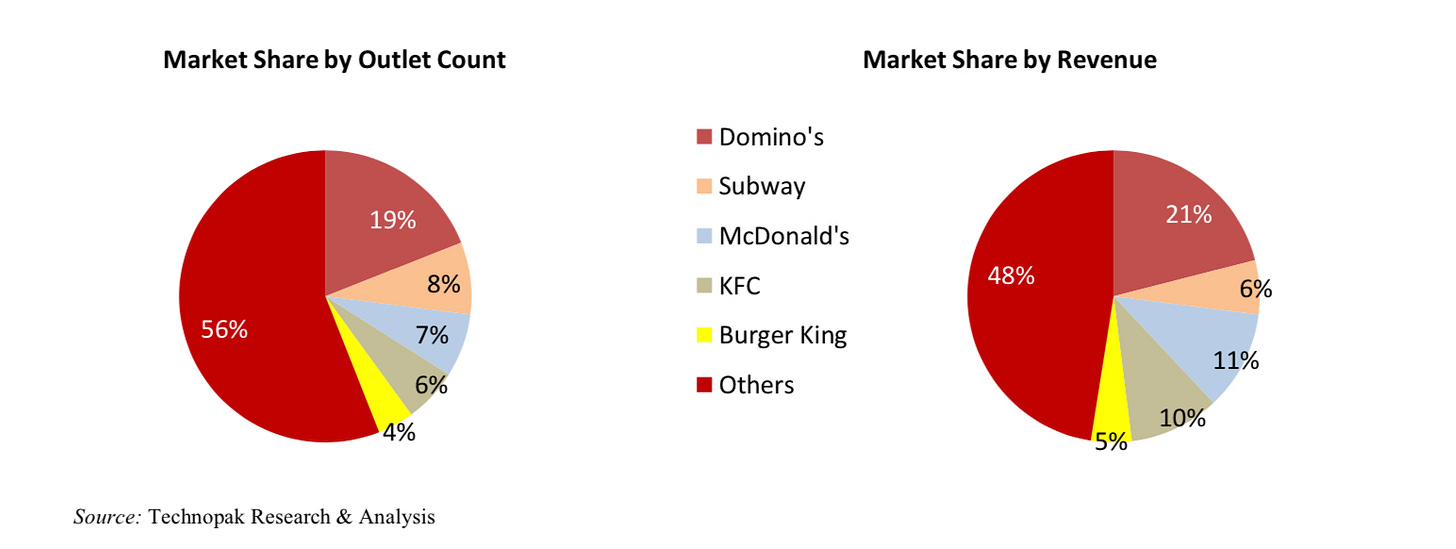

In India, Burger King was late to the party with McDonalds (market entry in 1996), KFC (2004), Subway (2001) and Domino’s (the market leader- 1996), already having vast food networks in the country, by the time BKI entered in 2015.

Burger King has thus had to play catch up and expand the network at an incredible rate. They followed a cluster based approach, first targeting the flagship locations with high traffic and high visibility, in the key metropolitan cities.

They built up their supply chains in those clusters, signing up with a third party distributor (ColdEX) but negotiating directly with the vendors (giving them control on quality and prices). They purchase their ingredients and packaging materials through this single 3rd party distributor, who in turn procures from BK’s approved suppliers.

Burger King India has 396 outlets, as of June 2023, and have started to expand beyond the metros and mall locations to tier 2 & 3 cities and towards high street locations. The stores are currently concentrated in the north and west of India and they will look to expand more in the South and East locations. The menu options play a big role here, as the QSRs like KFC with more non vegetarian options are more popular and have higher number of stores in the South. BKI has introduced similar options to increase South India penetration, while at the same time introduced “No onion No garlic” menus to expand in temple cities, in the North.

Few interesting points to note-

Burger King India (“BKI”) & McDonald’s have much higher employee & rental expenses on a per store basis, due to the larger size of stores, more employees and premium store locations. But they also have higher revenues per store to make up for that. Thus, the employee expenses as a % of revenue is lower.

It’s important to consider both the % of revenue and per store metrics, as Burger King India has around 25% of stores in the infant stage (stores open for less than 1 yr), which are not contributing heavily to the topline yet but increasing the expenses (rentals, employees, etc..). So while BKI has slightly lower gross margins than McDonald’s, they also have lower employee costs and rentals on a per store basis. Other major cost items like advertisement expenses and royalties are very similar, as these are paid out as a percentage of revenues anyways.

Thus, the area where BKI is lacking is in the revenues per store, which is only 60% of a McDonald’s store. This can be seen from the perspective of lower store maturity for BKI, and the trend has been positive, with the revenue per store being higher than pre covid, despite a poor H2’23 for BKI and the QSR industry as a whole. But this remains the major concern, as it will eventually be most important metric to drive the operating leverage at the store and company level.

The management has been focussed on increasing the store footfall post covid. They have increased advertising for their new value meal options- “Rs 99 Meals”. The company has also launched “BK Cafe”, in similar lines to “McCafe”, as well as more dessert options, which they hope will help increase the revenue per store numbers. Currently, Burger King has 286 BK cafes (so in 72% of their stores) and all new stores are launched with the Cafe. The Cafe is expected to increase footfall in breakfast and lunch times, and hence improve the revenue metrics.

The company has set up a layered menu strategy- starting with the value layer (the value meals), the Whopper layer (mid tier), & the King collection (premium layer) with the cafe/desserts layer on top of it all. The idea to increase the footfall through the value layer and than push for premiumisation through the other layers on the menu.

The company has made major investments upfront in the opening of the stores, setting up the supply chain, back end IT, etc. Most of these are fixed costs and as the company increases the stores in their clusters, they expect the operating leverage to play out from these investments. The company spends around Rs 30 million on each store opening, with an expected payback period of two to three years. While Covid disrupted some of their plans, the operating leverage can be seen kicking in with the increase in the Adj. EBITDA, and or Net Operating Profit after tax in FY23. (Adjusted EBITDA= EBITDA- Lease Liabilities, i.e. EBITDA pre Ind AS 116)

With costs in line with the peers, the sole focus is to increase the revenues from the stores, which will involve increasing the brand acceptability, targeted advertising and newer menu options.

Burger King Indonesia

RBA acquired an 87.75% stake in the PT Sari Burger Indonesia (“Burger King Indonesia”), in March 2022, for Rs 11,067 mn. The acquisition was made from PT Mitra Adiperkasa TBK (“MAP”) and F&B Asia Ventures (Singapore) Pte. Ltd (“F&B Asia”). F&B Asia is part of the promoter group (Everstone Capital), and hence this was a related party transaction. RBA raised funds for the acquisition, through a QIP of Rs 14,021 mn, for 108.5 mn shares of RBA at Rs 129.25/share. MAP (an Indonesian Lifestyle retailer) owns the remaining 12.25% stake in BK Indonesia.

Everstone (F&B Asia) acquired BK Indonesia in 2014, by purchasing a 68% stake from MAP, who own multiple malls in Indonesia, and hence most of their stores were in malls, at that time. Vaibhav Punj, took over as CEO and started expanding free standing drive through locations (FSDTs), in addition to the outlets in malls, and FSDT stores increased from zero to 71 (40% of all stores) in six years. According to the management, FSDTs are the backbone of QSR in Indonesia, as they have better ADS and margins than the mall locations.

As of June 2023, BK Indonesia has 169 stores, while market leader- KFC has 753 stores and McDonald’s - 227 stores. KFC is the clear leader in Indonesia, as chicken is a big menu item and makes up for around 60-70% of the industry sales. RBA’s Indonesian business has been making losses since Covid (CY2020) and they have struggled to turn it around (the management has missed multiple self set timelines, and are now expecting to turn profitable in FY24). One of the major reasons is a lot of malls in Indonesia have become defunct post covid and hence the company has had to “rationalise” their stores (as they were very much mall dependent), to return to profitability. The company has also had a change in management last year, with Vaibhav Punj, who took over in 2014, leaving the company and being replaced by Sandeep Dey, who was head of Supply chain for BKI and then head of Popeyes Indonesia.

Burger King Indonesia, was making decent margins pre-covid. The ADS was in line with market leaders like KFC.

Since Covid though the results have deteriorated massively. The same though is true for the other QSRs as well. Though, the losses have been larger for Burger King, due to its higher concentration in malls (which are among the worst performers).

The brand acceptability of KFC is much higher, and can be seen in the much lower Ad expense (as % of Revenue), and higher gross margins. They also have much small stores (due to their “KFC Box” outlets), hence lower rentals & employee expenses per store. Due to the inflation- wages, power costs, have risen across the board, requiring even higher revenues to meet the pre-covid margins.

Burger King reached 75% of its pre-covid ‘revenue per store’ numbers in FY23. The losses have increased (compared to FY22) due to the company increasing ad expenses and the rental concessions going away. While Fast Food (KFC) has managed to get to 85% of its pre covid ‘revenue per store’ numbers, the recovery has been slow across the QSR space in Indonesia.

Burger King Indonesia has made significant investments in FY23, in revamping the menu, supply chain and rationalising store network. They closed 7 stores in Q1 of FY24 and plan to close a few more in Q2 - most of these outlets are in malls, that have not been able to get back to pre-covid highs due to lower footfalls. Burger King did extensive consumer surveys last year to establish new product lines, fill the gaps in the menu, & improve the taste and quality of their existing products. The new product strategy was rolled out in Q1 FY24. The strategy has three pillars- chicken, burger and desserts, in order of importance. The company has also launched value meals, similar to the Indian menu, with additional premium layers over that. The management expects Burger King Indonesia to breakeven in FY24. Burger King reported improved numbers in Q1 FY24, with ‘revenue per store’ of IDR 7,081 mn (81% of pre covid), the company expects to breakeven at IDR 7,665 mn. (pre-covid FY19- IDR 8,760 mn.)

Popeyes Indonesia

The Indonesian subsidiary (PT Sari Burger) also acquired the franchise rights for Popeyes (under PT Sari Chicken) and have a target of 125 stores in next 5 years (with a long term target of 300). They launched their first store in December 2022, and are on track to have 25 stores by end of FY24. Popeyes is similar to KFC, in that its a chicken based QSR ( also belonging to Restaurant Brand International- parent of Burger King). It is known for its fried chicken and chicken sandwich.

While, it’s still very early days for Popeyes, the initial numbers are very good. The revenue per store from the first 10 stores in Q1’24, was more than 2x Burger King’s.

Promoters & Management (Principal & Agents)-

As mentioned earlier, the promoters of RBA- QSR Asia (“Everstone Capital”), sold 25% stake in open market in Sept 2023. Largest stakes were acquired by ICICI Prudential Life Insurance (6.9%) & Plutus Wealth Management (6%), rest were smaller stakes acquired by mutual funds. The promoters (Everstone) have been looking for an exit for a long time and were unable to reach an agreement with a single buyer for the acquisition of their 40% stake. QSR Asia still has 15% stake in the company, as of Sept’23.

Being a PE fund itself, the day to day management of the company was not dependent on the promoters. The current management feels there will be no change in the working of the company, and they have a strategy in place, which will continue to be executed, no matter who owns the company.

The current board of directors, have three directors representing Everstone Capital, the CEO- Rajeev Varman, one director representing RBI (Burger King’s parent) and three independent directors. With Everstone expected to sell its stake completely, it will be interesting to see who replaces them to look after the interests of the shareholders, as there won’t be an out and out largest shareholder anymore. Board representation for shareholders is essential to stop the management from taking decisions that may hurt shareholders interests in the future.

Risks-

The company needs to open 700 stores of Burger King in India by Dec’2026. While that number is not huge for a country like India, the pace of these openings can lead to execution risks, where the stores are opened in locations that are not ideal, and lead to resources being wasted.

Increasing the brand awareness and acceptability in India will be key. Opening the stores is one thing, actually getting the footfall in is another. The competition in the Indian market is immense, with a number of other QSRs also entering the country, and many home grown brands coming up as well, not to take away anything from the local street food, which continues to be strong.

The company bought the Indonesian subsidiary for 12 times its CY19 (pre-covid) EBITDA, which was reasonable. But the company has been unable to get anywhere near those numbers yet, which makes this a very costly acquisition for now. So turning around the Indonesian subsidiary, will be of key importance.

Conclusion

RBA is clearly lagging behind its peers in profitability metrics. The reason is that in India, the business is yet to see the operating leverage kick in, which is dependent on them increasing the per store revenues. With the incremental store additions getting lower and lower as a % of total stores in India, the picture will be much clearer in a couple of years, whether the mature stores are able to deliver the per store revenues similar to other QSRs. Given the global presence of the brand, one would expect it to match its international peers in India as well.

While in Indonesia, they are looking to turnaround the loss making business and get back to profitability. The recovery is dependent on them shifting their store from malls to FSDTs and improving the store’s unit economics. The recovery has also been delayed by poor economic conditions in Indonesia and inflationary pressures. The franchise agreement for Popeyes, also allows them to launch joint stores with Popeyes and Burger King in the same location, which can help in the turnaround as well. IF the Indonesian subsidiary cash breakeven in FY24 it will improve RBA’s profitability materially.

So the potential is huge given the number of stores the company already has on the ground (558 stores in total as of Sept’23). Due to nature of this business, once operating leverage kicks in, the profitability metrics improve quiet quickly. But the jury is still out for now !!

Hi!

If you liked the above letter, consider subscribing to our newsletter. We have covered a number of other companies- CIE India, L&T Finance, among others. You can check those out here. See you soon!!

Thanks for reading!!

You can also find us on Twitter.