Hi fellow investor,

( Disclosure: I do not own shares of V-Mart Ltd. My views on the company may be biased. Everything I conclude in the article is solely my opinion, based on publicly available information. This should not be taken as financial advice. This is purely for educational purpose.)

Let’s get straight into it.

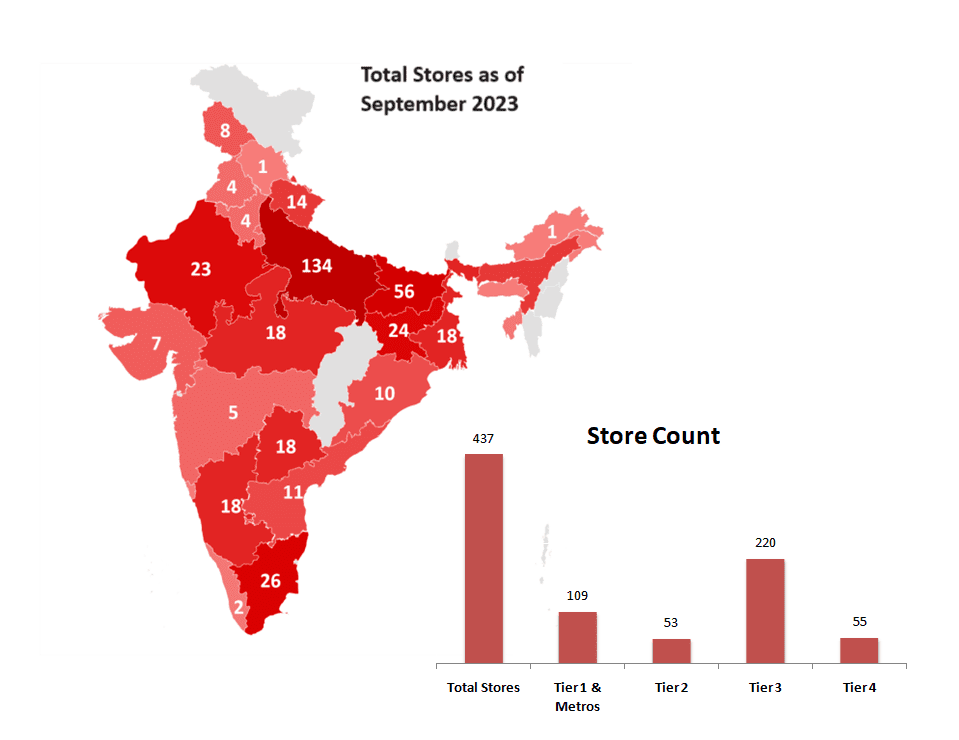

V-Mart Ltd operates in the value-for-money retail segment. The company opened its first stores in Gujarat in 2003. V-Mart sells apparels, general merchandise (non-apparels and home mart) as well as Grocery items in some of its stores. The company was founded by Mr. Lalit Agarwal (Current MD), he along with his family members hold 44.34% stake in the company (as of Sept’23). The company currently operates 437 stores across India, with 63% of the stores in Tier-III and Tier-IV cities. The company operates stores under two brands- V-Mart and Unlimited. The V-Mart stores are located in North, East and West regions, while Unlimited stores are solely in the South.

V-Mart acquired 74 ‘Unlimited’ stores from Arvind Fashion in FY22, for a total consideration of Rs 1,680 mn, including Rs 540 mn for the fixed assets, Rs 830 mn worth of inventory and Rs 320 mn for security deposits of the stores and warehouses.

V-Mart has based their store expansion strategy on a cluster based approach, with stores being located 100-150 km from one another, to improve efficiencies in brand spending, procurement, logistics, and inventory management. There are 353 ‘V-Mart’ stores, with 54% of them in Uttar Pradesh and Bihar.

The company’s target customers are those with monthly household income in the range of Rs 20,000 - Rs 50,000. There are about 160 mn households in that income bracket in India, as of 2022. The Indian retail market is still dominated by the unorganised sector, accounting for 81% of the market in 2022 (88% in 2019). The remaining is organised retail, with brick and mortar retail taking 12% and e-commerce with 7%. V-Mart’s business model is to target this large middle class population residing in tier 2, 3 and 4 cities. The lease rentals in these cities are typically lower than in tier 1 or metro locations, and this lowers the payback period for the company. V-Mart spends around Rs 1400 per sq. ft. on setting up each store, and are typically profitable after 4 months of launch. The payback period for the investment is around 2 years.

All the V-Mart stores are on lease, with tenors of 9-12 yrs. The store sizes range from 7,000 sq. ft. to 10,000 sq. ft. They operate all their stores themselves. The staff personnel are locally hired and given appropriate training at other mature stores. The company has a team of designers and merchandisers who work together to buy products based on the latest trends and matching the local preferences. V-Mart doesn’t have any manufacturing of its own, it procures the readymade garments from vendors. The company sells both private label and other branded garments in its stores. Private label accounted for around 53% of the apparel sales in FY23 (5yr Average is 55%).

V-Mart benefitted from first-mover advantage as they expanded into the tier 3/4 cities. They provided a more comfortable and premium shopping experience to the buyers in these small towns but at a very reasonable price. This helped them gain market share from the local players in those markets.

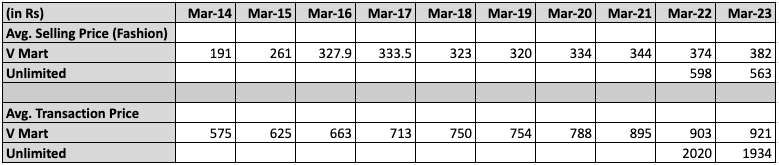

The company saw good growth in Footfalls as they kept adding stores. Interesting to note though, the footfall psf of space remained similar (see below). The company was targeting 10% SSG Sales growth, but from FY14 to FY20 (11 months, excl. March 2020 lockdown) they averaged 6.6%. In that time the Sales per Sq. ft. per month averaged Rs 680 for the ‘V-Mart’ stores. The customers were buying more products per trip, as the Avg Selling prices remained similar, but the Transaction Sizes went up. So growth was fueled by a similar number of customers, buying more products.

The major shift though can be seen in the performance after Covid hit. While the hit to footfall and same store sales growth was expected in FY21 due to lockdowns, the company has not yet fully recovered from that fall. The major fall can be seen in the footfall in the stores, which in FY23 was just less than 60% of pre-covid. The Sales per Sq ft for ‘V-Mart’ stores was Rs 578 psf pm, which is again 87% of pre-covid. This is after the company increased the average selling price in their stores by 20% compared to pre-covid levels.

So the question is what led to this fall ?

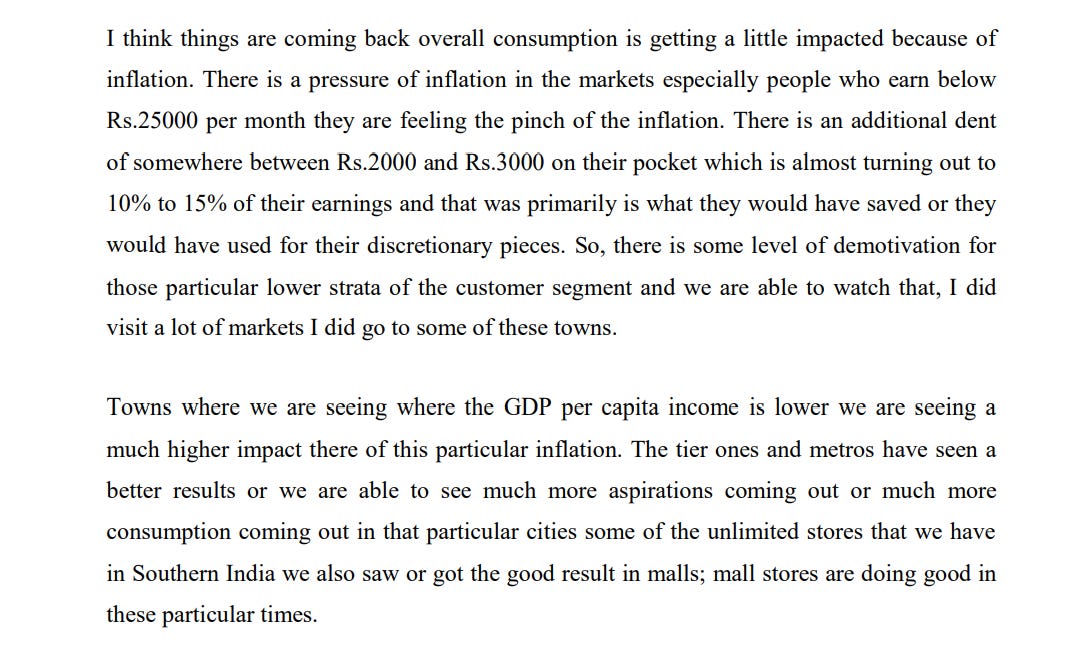

Inflation- The prices of consumer goods have increased by about 20% since March 2020, and this has hurt consumer sentiment especially in the lower income households. The prices of fashion & accessories, that make up around 90% of V-Mart revenues, have increased even more. The recovery in the Indian economy post covid has been led by the tier 1 and metro cities and consumption has mainly increased in the high income households. This can be seen in the result of the FMCG companies, who have seen volumes in rural regions go down.

Increased Competition- The competitive intensity in the retail segment was very high, especially in the tier 2 and 3 cities, even before Covid. This could be seen in the lower than expected same store sales growth numbers for V-Mart. The company faces competition from the likes of Reliance (Trends, Smart Bazaar), Spencer’s, Max Fashion, etc in the offline space. The major point of differentiation though remains price, the MD believes that most of the national competitors are 30%-50% more expensive than V-Mart (in ASP terms). Though this will vary from product to product. In FY23, for V-Mart, 56% of the items sold were priced <Rs 499, 30% were priced between Rs 500 and Rs 899, and 14% were priced more than Rs 899. There is increasing amount of competition coming up in the value retail segment (products priced less than Rs 999), with Shoppers Stop’s Intune, Trent’s Zudio and Reliance’s Yousta. This increased competition will not only affect sales/footfall for the existing stores but due to the lack of high street locations in the smaller towns, also lead to higher rental costs for companies.

According to the Unicommerce 2022 Report, the share of unorganised retail in the apparel segment is 56%, organised brick and mortar is 24% and online retail is 20%. The interesting thing here is how close the market share is between brick and mortar and online segments. Acc. to the report, the fashion segment is one of the most mature ecommerce markets, and online market novices typically start with purchases from the fashion segment. The even more fascinating part is that Tier 3+ cities accounted for 37.6% of total ecommerce orders (tier 1 was 38.7%, tier 2 was 23.7%) in 2022. The overall penetration of ecommerce in India’s tier 3+ retail market is 3.5%, compared to 4.5% for the Brick and Mortar organised retail. The online fashion e-commerce market is dominated by a few players with the Flipkart Group having the largest market share of 48%.

Operations-

The profitability was also severely hit since FY20, and even adjusting for the Rs 441 mn loss from Limeroad ( an ecommerce site acquired last yr), the FY23 OPM comes to 5.27%.

The reduced sales per sq. ft. has also led to higher inventory in the stores, leading to higher cash conversion days. Thus increasing working capital requirement, and reducing Operating Cash flow. The increased capital expenditure into new stores, new warehouses, Limeroad and Unlimited, has lead to the company going from being Rs 795 mn in net cash in FY19 to Rs 1,190 mn in net debt in FY23.

E-Commerce Foray

The company bought Limeroad in FY23, by assuming all its liabilities of around Rs 352 mn. This was a distress buy- Limeroad was going through a cash crunch, and the existing investors (Tiger Global, Lightspeed Ventures, etc.) weren’t willing to put in any more money into this business. V-Mart took this opportunity to fastrack their omnichannel plans, & establish a wider geographical presence. Limeroad is an e-commerce marketplace offering a wide range of fashion accessories for both men and women. They do not hold any inventory and have negative working capital. They charge around 40%+ platform fee from the sellers and provide low cost fulfillment. The business was EBITDA profitable in FY19, when it had a Gross Merchandise value (GMV) of Rs 9bn. As of Sept 2023- their half yr GMV was around Rs 3bn, with an EBITDA loss of Rs 453 mn. V-Mart is looking to invest around Rs 700 mn into Limeroad, with most of it going towards marketing expenses, to regain the pre-covid GMV and achieve profitability. They have managed to reduce monthly cash burn to Rs 66mn in Q2 FY24 from Rs 88 mn at the time of acquisition. V-Mart is aiming to achieve online sales of 20% of total revenues in the next 2 years. V-Mart is working to integrate its entire store inventory with Limeroad, and are hoping for incremental store sales from that channel, while Limeroad gets the last mile connectivity through its 400+ stores. V-Mart has retained the entire workforce of Limeroad and the company will continue to be headed by its founder and CEO Suchi Mukherjee. They intend to run Limeroad as a separate business unit within V-Mart to preserve the “start-up culture”.

Expansion to the South

V-Mart acquired 74 ‘Unlimited’ stores in FY22. This allowed them to foray into South India. They decided to not change the branding to ‘V-Mart’ as they found good loyalty to the existing brand name. The stores were losing money at the time of acquisition. They revamped the inventory, started sourcing the products from V-Mart’s vendors-reducing Avg. Selling Price by 7%, and started expanding the stores in tier 3 and 4 cities in the South. In the first full year of operations (FY23), 80% of the stores turned profitable (pre-Ind As). This acquisition has reduced the dependence of the company on the states of UP and Bihar, where they are facing high competition. The ‘Unlimited’ stores have higher gross margins than ‘V-Mart’, as they have higher ASP for similar products. But the overall profitability should be similar or slightly lower, due to the higher employee expenses and rentals in South India.

Strategy going forward-

While the company continues to increase its online presence through its own site (Limeroad) as well as putting inventory on other marketplaces like Amazon & Myntra, the store footfall must also increase to improve the overall store profitability. Historically, V-Mart has had an excellent record with profitability, and their recent success with turning around the ‘Unlimited’ stores also supports that.

In the first half of FY24, to restore footfall the company has decided to reduce the ASP and increase promotional activities. They reduced ‘V-Mart’ ASPs by 7% and ‘Unlimited’ by 17% in the first half of FY24, leading to an overall ASP fall of 10%. While the footfalls increased by 18% YoY, the margins were hit, and they reported an EBITDA loss of Rs 11 mn (Pre Ind As) excluding Limeroad.

The management thinks that this strategy is the right way to go, and as the rural economy improves and footfalls increase, they will return to profitability in the second half of FY24. The reduced prices and increased promotions is also aimed to put pressure on the competitors.

Back of the hand calculations-

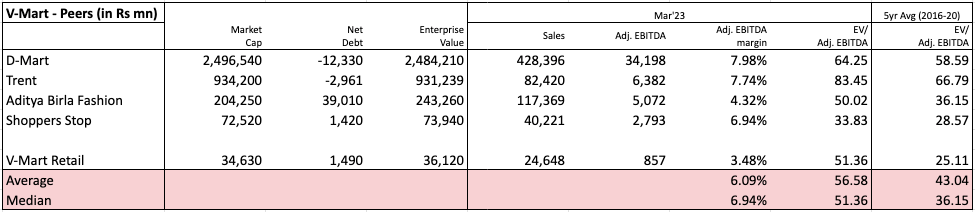

The company is currently trading at an EV of around Rs 36 bn. In their best year, V-Mart made an operating profit of Rs 1.3 bn, that’s an EV/EBITDA of 27x, compared to a pre-covid (not taking last three years because numbers are affected by covid) 5 year average of 25x.

If the company were to reach the pre-covid OPM of 10% again, with the increased number of stores, they could potentially make Operating profits of around Rs 3bn (taking pre covid sales per sq ft per month of Rs 680 for its current retail space), and in that case, V-Mart is trading at an EV/(current potential EBITDA) of 12x. A lot of things have to go right for them to post these numbers. This is not accounting for Limeroad losses/profits, as I think there is very little track record there to be sure, compared to the brick and mortar business. The company will also look to increase retail space by 10% to 15% per year, so the above calculations will change with that. Important to note that in FY23, ‘V-Mart’ and ‘Unlimited’ reported Sales per sq. ft. per month of Rs 578 and Rs 456, respectively. So they are currently way off that Rs 680 number.

Peer Comparison-

Concluding Thoughts-

I think it’s fair to assume that a large part of the fall in the volumes is due to the weakened rural economy. An improvement in rural consumption should improve the operational metrics for V-Mart. But since Covid, the supply in the market has also increased and its difficult to see this competitive intensity reducing. Most of the national competitors have much more cash to burn, and they are all targeting the value retail segment. The e-commerce business is an ambitious play and they are hoping to develop a niche in the market and not compete directly with the larger players. But e-commerce is a tough market to breach and even tougher to generate meaningful cash from that business. With this much competitive intensity, consistent same store sales growth will be tough to achieve, despite the overall apparel market growing.

Hi!

If you liked the above letter, we have covered a number of other companies as well- Restaurant Brand Asia, CIE India, L&T Finance, among others. You can check those out here.

See you soon!!

Thanks for reading!!

You can also find us on Twitter.