Hi fellow investor,

( Disclosure: I don't own any shares of Wonderla Holidays Ltd. Everything I conclude in the article is solely my opinion, based on publicly available information. This should not be taken as financial advice. This is purely for educational purpose.)

Let’s get straight into it.

Wonderla Holidays was started in 2000, when the founder- Mr. Kochouseph Chittilappilly setup their first amusement park in Kochi (then known as Veegaland). Since then Wonderla has added two more amusement parks, one in Bangalore (in 2005) & the other in Hyderabad (in 2016), as well as an 84 room resort in the Bangalore Park (in 2012). The company is currently being lead by the founder’s son- Mr. Arun K. Chittilappilly, who is the Managing Director. The promoter and founder of the company- Mr. K. Chittilappilly, also founded V-Guard Industries in 1996, a company manufacturing Electricals and consumer durables, with sales of Rs 27,419 mn and PAT of Rs 2,008 mn in FY21. V-Guard is being managed by the founder’s other son- Mr. Mithun K. Chittilappilly.

Wonderla saw a footfall of around 2.38 mn people in FY20, recording revenues of Rs 2708.8 mn. The company has faced a numerous challenges in the last five years, with changes in tax laws (imposition of service tax in 2016 and then GST in 2017), extreme weather conditions and Virus outbreaks (Covid-19 in 2020 and Nipah Virus in 2018).

Covid-19 lockdowns forced the company to shutdown down their parks for most of FY21. The Bangalore park opened on 9th November 2020, Kochi Park on 20th December 2020 and Hyderabad Park on 7th January 2021. The parks were operating at 50% capacity, due to government guidelines around social distancing. In FY21, the company recorded footfall of 0.35mn, with Revenues of Rs 384.2 mn and a Loss after tax of Rs 499.3 mn. The company ended FY21 with Cash & Investments of Rs 929 mn, suffering a cash loss of Rs 309mn during the year. The company is still in a strong position financially, with a debt free balance sheet and undrawn working capital facilities of Rs 250 mn.

Wonderla Holidays has three major revenue sources- Amusement Park entry fees, Resort room rentals and Food & Merchandise.

While the majority of the revenue continues to be made from entry fees, the contribution from food and merchandise has increased significantly over the last decade. Prior to FY15, the management used to lease out the restaurant spaces in the park to third party caterers, and got paid on a revenue sharing basis. From FY15 onwards, the management started operating some of the restaurants themselves (took control of all restaurants from FY18 onwards). They started offering deals to tour operators and visitors (like three meals for just Rs 299), leading to significant increase in Food revenues.

The management also changed the rules for their water park, requiring compulsory nylon clothing- “to maintain water hygiene”, this increased the merchandise sales in the park, where they offered t-shirts starting from Rs150.

In 2016, the company also launched an e-wallet- Ez Pay, with cashless RFID-based transactions facility, which allowed visitors to make payments across the park with a wristband. This was first piloted in the Hyderabad park and then rolled out at all their parks. The visitors generally don’t carry their wallets into water parks, leaving them in their lockers, having such wristbands (at no extra cost) should lead to higher purchases.

Wonderla Holidays has consistently made profits in the past decade, with operating margins consistently over 40%. The launch of the new park in Hyderabad in FY17, affected the profitability, with increase in advertising spend and employee expenses. Service tax of 14% was imposed on admission to amusement parks in 2015, the company disputed this and challenged the decision in Karnataka and Kerala High Courts, and consequently for every year from FY16 to FY19, the company had to take provision for the tax including interest on their books, the amount was included in “Other Expenses”, under “Rates and taxes”, hence affecting the EBITDA. The company settled the tax dispute in FY20, through the ‘Sabka Vishwas Resolution Scheme’, reversing provisions of Rs 189mn( included “other income”), out of total provisions of Rs 552 mn.

Wonderla runs one of the most profitable amusement parks in the country. They have managed to do this, due to their lower outlay on land, and their in-house ride manufacturing facility in Kochi. The company has an experienced group of engineers, that allow them to design & produce rides at a lower cost to their competitors and also reduces maintenance cost of their imported rides. The company due to this in-house capabilities has often managed to buy older rides at a steep discount from theme parks around the world, refurbish them and use them at their parks. To maintain the safety of their rides the company has contracted- TUV Germany, to visit their parks every year, do checks on their high thrill rides to test their safety and quality. The Park management, also do pre-opening checks every morning, monthly checks by supervisors, and yearly shutdown maintenance on integral parts of the rides.

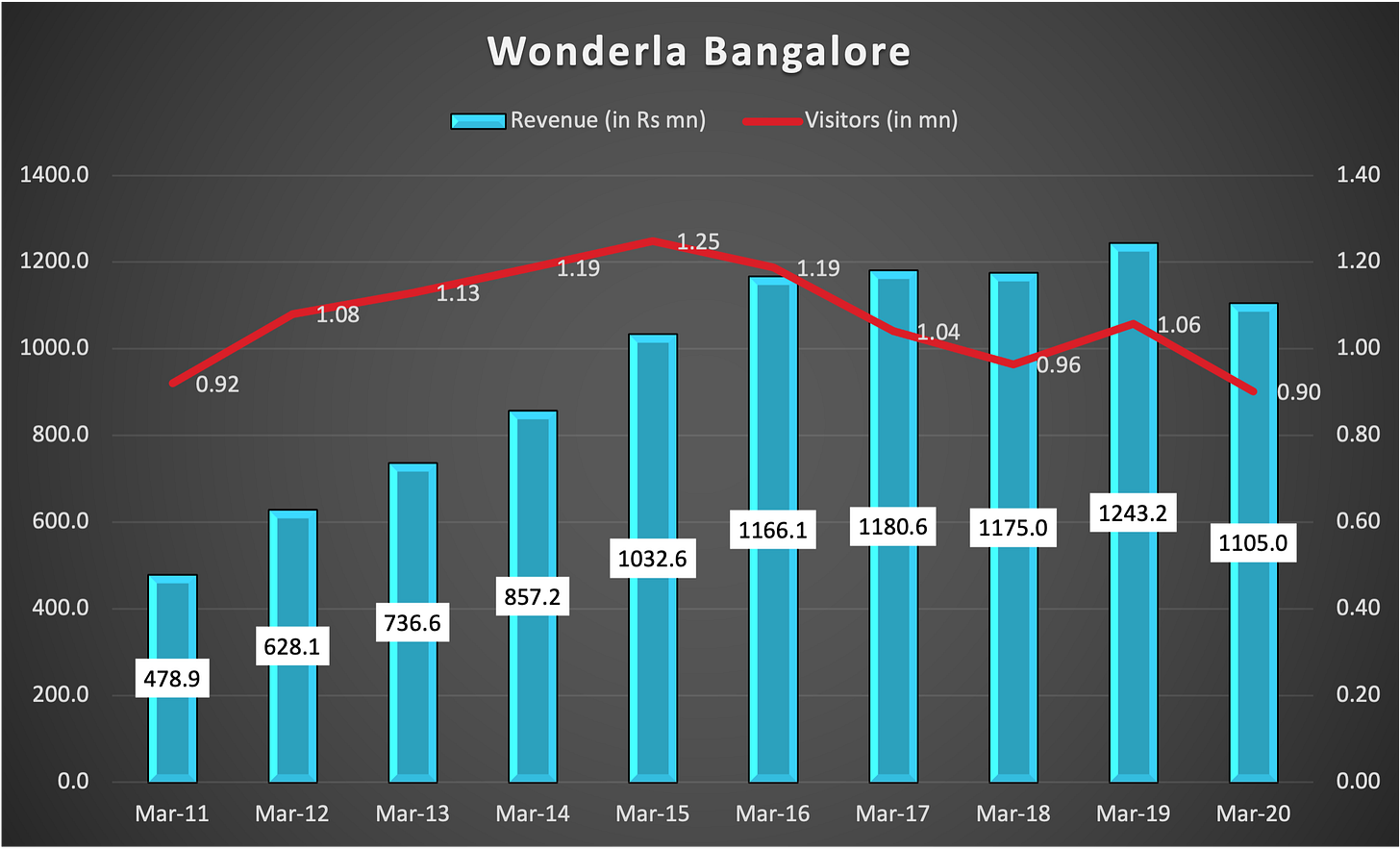

Wonderla Bangalore

Wonderla opened its amusement park in Bangalore in 2005. It is spread over an area of 39 acres, with additional undeveloped land of around 42.5 acres. The park is around 30kms from Bangalore city, and sees an annual footfall of around 1mn. The Bangalore park is the flagship property of Wonderla, with 62 rides- 21 wet and 41 dry rides. The park contributed Rs 1105 mn in revenues, or 41% of the total revenue of Wonderla Holidays in FY20. The footfall at the park though has been decreasing since peaking in FY15.

The change in footfall each year, can be attributed to a number of issues-

In FY17, service tax of 14% imposed, the park was closed for 22 days in Q2 due to the Cauvery Water Dispute and then school exam were postponed to Q4 due to bandhs.

In FY18, GST of 28% imposed on amusement parks entrance tickets.

In FY19, company reduced the ticket prices to pass on the GST reduction from 28% to 18%.

In FY20, increased rainfall in Q2 & Q3, and then Covid-19 caused the park to be shut from March 2020.

The Bangalore Park makes 50% of its revenues in the Q1, followed by 25% in Q3. The park seems to be doing well during the peak seasons, with the footfalls coming back in FY19 & FY20. The major drop off is during the off season(Q2 & Q4). While FY20 can be seen as an anomaly, with much higher rainfalls in Q2 & Q3 and Covid lockdown in Q4, the footfall in FY19 was still 12% down from FY16. The revenues have not been affected much due to increased revenue contribution from Food and Merchandise and increased revenues in Q1.

Wonderla Kochi

Wonderla inaugurated its first amusement park in Kochi, Kerala in 2000. The park is spread across 28 acres, with additional 64 acres of land still undeveloped. The park has 56 rides - 22 wet rides and 34 dry rides. The Kochi park contributed around 28% of the overall revenue of Wonderla Holidays in FY20.

The footfall in the park is down 35% from highs of FY13 to FY20, while the revenue in the same time has increased by 26%, mostly due to increase in sale of food and merchandise.

While the park continues to do well in the Q1, with improvement both in ticket prices and footfall in FY20, the footfall in Q3 continues to be flat , despite limited increase in prices. In FY19, the park was shutdown due to extreme rainfall and floods in the first half of the year. This lead to the sharp downturn in footfall in Q2’FY19. The Sabarmati Temple protests, also lead to lower tourists in Kerala in FY19. In FY20, while Q1 & Q3 (peak season) saw some improvement, Q2 was disrupted by high rainfalls again, and Q4 was affected by Covid.

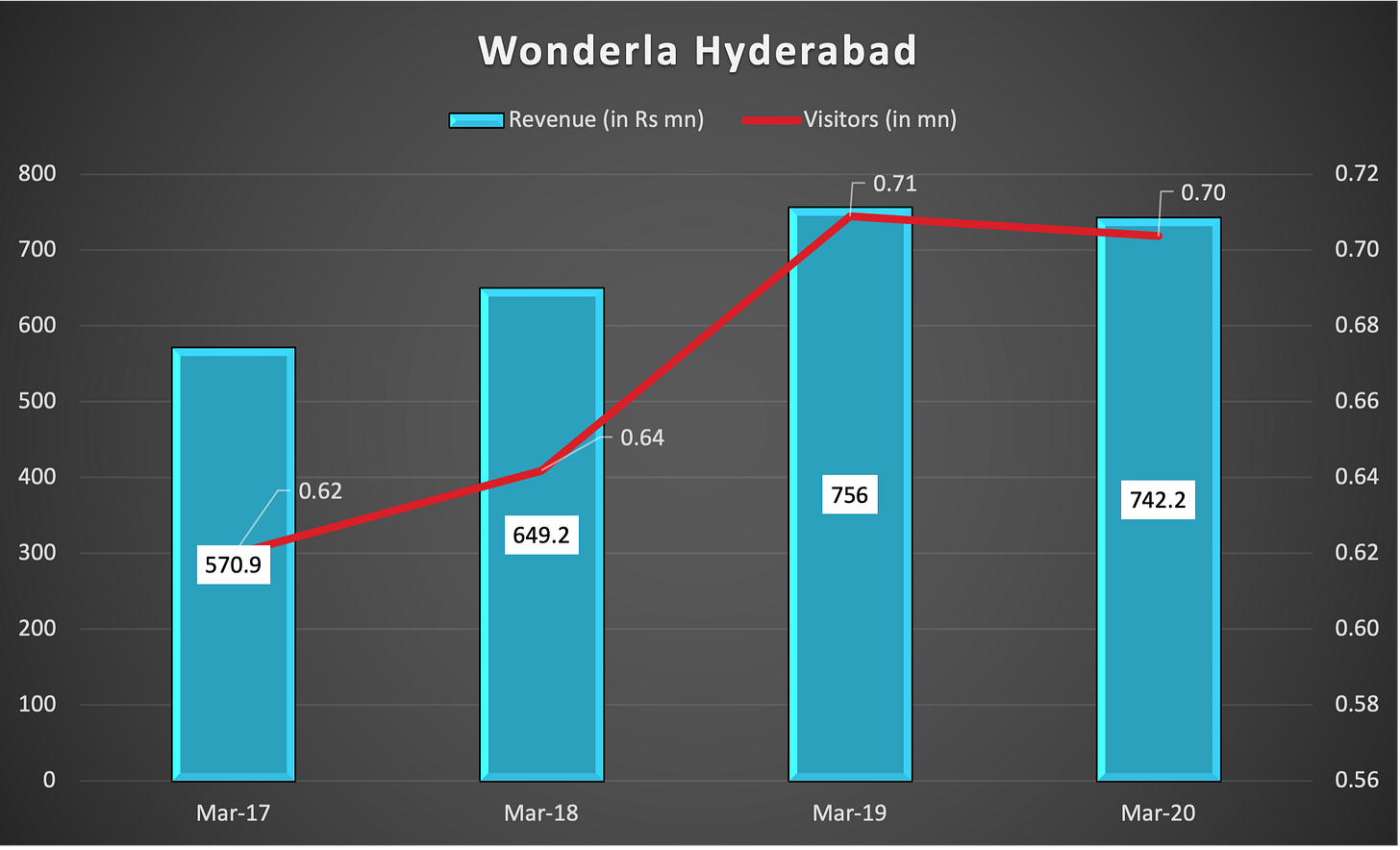

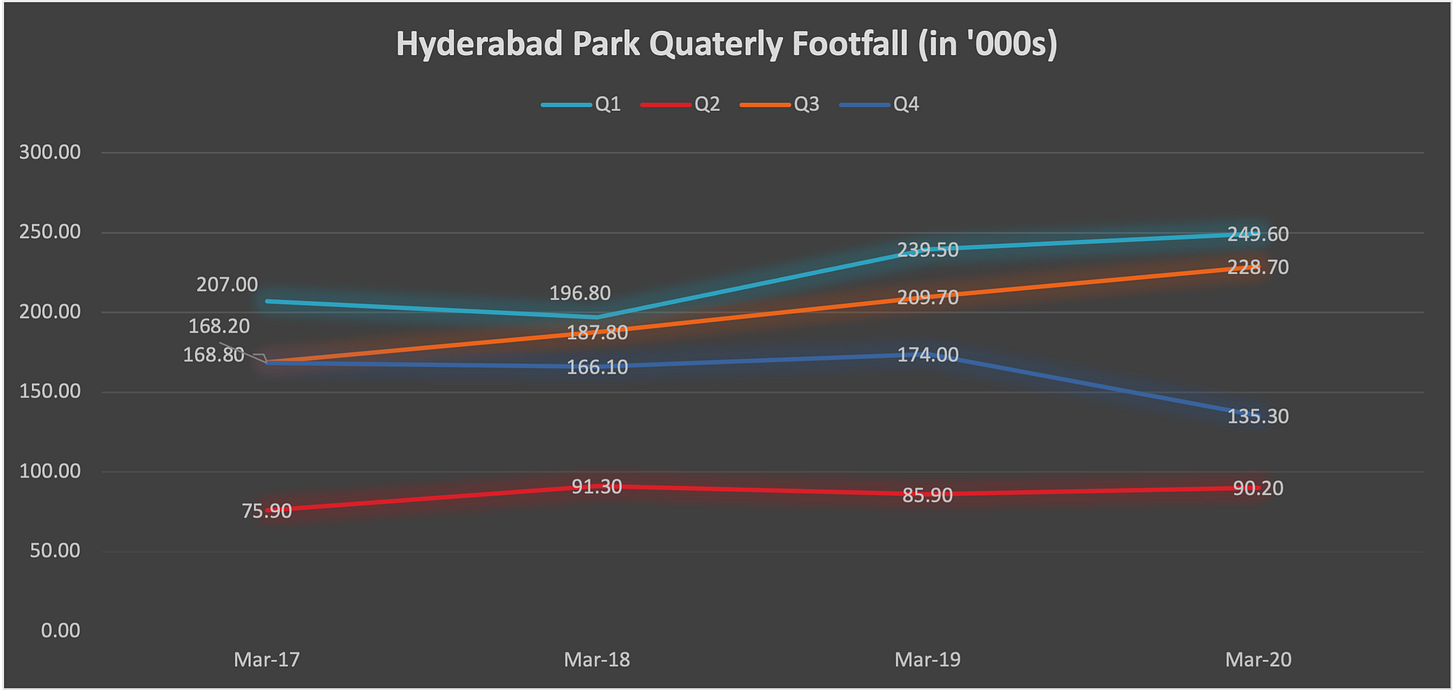

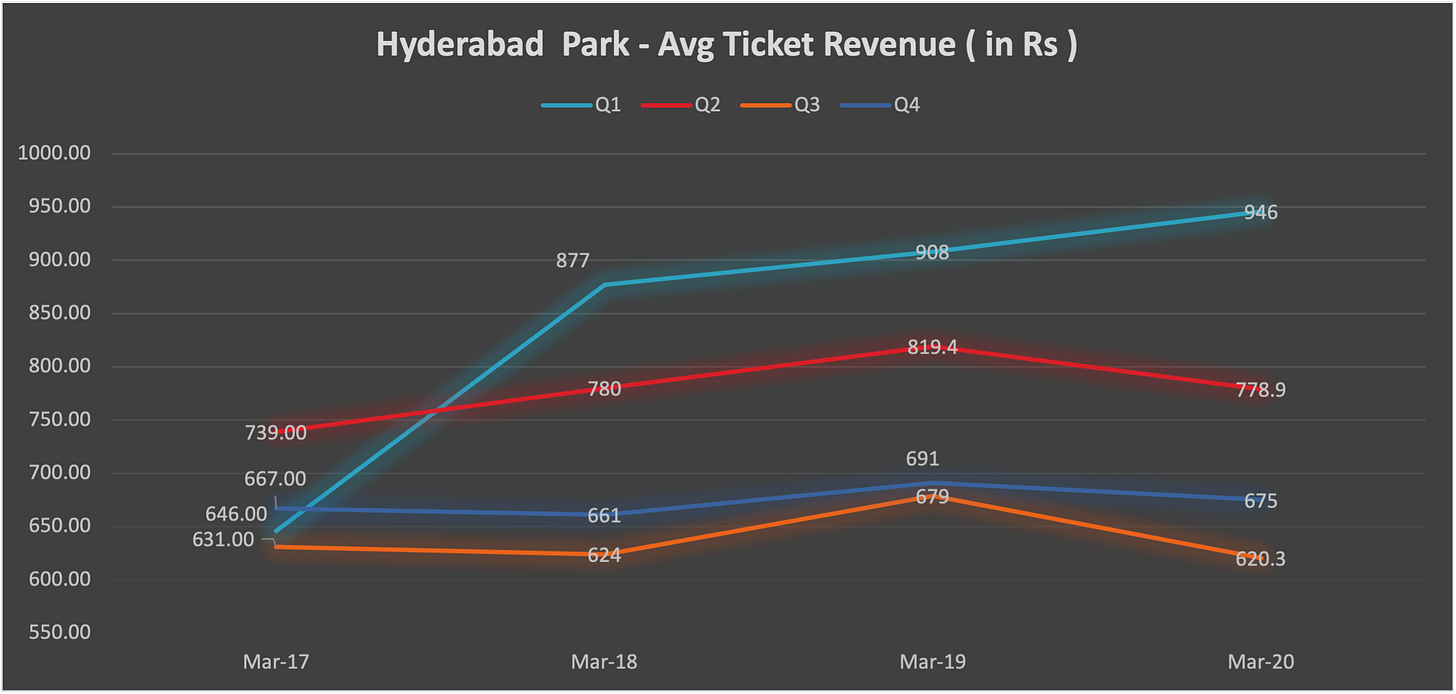

Wonderla Hyderabad

Wonderla opened the Hyderabad Park on April 2016. The park has 44 rides- 18 wet and 26 dry rides, spread across an area of 27 acres, with undeveloped land of 22.5 acres. The park attained EBITDA level profitability in the first year itself. The park saw a footfall of 703 thousand & recorded revenues of Rs 742 mn in FY20. The company invested 2750mn in setting up this park, and expects a payback period of about 12 years. The expectations from the park has been lowered by the management, as they initially expected this park to be as big as the Bangalore Park, with similar numbers from the 5th year onwards. The increase in taxes on amusement parks (with 18% GST), has reduced the profitability. Except for Q4’FY20, the park has seen improved numbers every Quarter. While Q1 continues to be the most important Q, with increased footfall and higher average ticket prices, Q2 seems to be the worst quarter (among all parks even), with management indicating lower turnouts due to higher temperatures in Hyderabad during the summer months.

Wonderla Bangalore Resort

The 84 room resort was opened in 2012, inside the premises of the Bangalore Park. It contributed around 4% of the Total Revenue in FY20. The resort doesn’t contribute much in terms of footfall to the park, and has only crossed 50% occupancy once, in the last five years. The EBIT margin over the last three years has been around 15%.

Peer Comparison

Wonderla Bangalore was ranked 2nd best amusement park in India by Tripadvisor Traveller’s Choice 2020, while Wonderla Kochi was ranked #6. Wonderla Hyderabad wasn’t in the top 10 list, but its near door neighbour Ramoji Film City was ranked #1. Among the listed peers, Nicco Park was #8, while Imagica wasn’t in the top 10.

Wonderla is one of the most affordable large amusement parks in the country, that has single ticket for both water park and dry rides, and costs around Rs 1000 per adult. Peers like Essel World charge separately for both, costing around Rs 1500 for both, while a single ticket to Imagica costs Rs 1500 as well.

There are more than 150 amusement parks in the country with only 15-20 large parks (larger than 30acres). It has become quite difficult to setup new amusement parks, especially the larger ones in metro cities. The biggest challenge being land acquisition. With large parks requiring at least 30 acres of land, finding that in a metro city is extremely difficult. Add to this the cost of importing rides and maintaining them, setting up an amusement park is not easy.

Internationally, Amusement parks are dominated by large US players like Disney World, Universal Studios, Six Flags & Sea World. Most of them have used their intellectual property rights in the form of major film franchises, characters and other entertainment to their advantage. The economics of the park, also differ, the international parks, make only 35% of their revenues from entry fees, while the rest are from resorts, foods, and merchandising.

In India, the economics are 75% from entry fees, while services like food and merchandising account for 25%. The difference is largely due to the lower discretionary spending power of the target audience. The Wonderla management hence doesn’t believe that a Disney or Universal Park would work in an Indian setting. But the Indian players still lack the IP rights, and if any of the existing players or new players partners with these International giants, then parks like Wonderla may be under risk.

Outlook-

The Kochi and Bangalore Parks are 20yrs and 15 yrs old respectively. The management has to keep adding newer rides and attractions to keep pulling in the crowd. While Wonderla has spent around Rs 4577 mn in the last seven years, majority of this has been towards newer parks, namely Hyderabad and Chennai. The Hyderabad Park is still in its early stages, the company is working on pulling in larger crowds from the city and nearby states and still expects to achieve 1mn footfall in a couple of years time.

The Chennai Park has been under planning since 2015, and the company has spent Rs 1100 mn till FY21 (off the 3500mn budgeted cost), for acquiring about 64 acres of land and some construction activities. The project was delayed initially due to ongoing negotiations with the Tamil Nadu government, for exemption from the levy of 10% entertainment tax on entry fees into the park. The government granted an exemption for 5yrs, from date of commencement of the park or Sept’30, 2021, whichever was earlier. Due to covid, the construction had to be stopped and the company is asking for a postponement of the exemption period. The management has also indicated that they are re-negotiating the terms and want a lifetime exemption from the tax, which they feel is excessive given the already high 18% GST. Once the construction is underway, they expect to complete in 18 to 24 months.

The company has also signed an MoU with the Odisha Government, which approached the company to setup an amusement park in the state. The government has offered a 90yr lease at just Rs 30mn, for 50 acres of land, with direct access to the National Highway, and potable water connection from the river. The company has accepted the offer, and agreed to setup a water park with an initial investment of Rs 750mn to 1000mn. The project has to be completed in 3 years time from FY20, expect this to be extended given Covid.

Wonderla generated an average operating cash flow of Rs 825mn in the last three years. With the Hyderabad Park improving its metrics, and full year of normalcy in the other two parks, they should be able to easily achieve more than Rs 1bn in operating cash flows from FY23 onwards. Wonderla has Rs 929 mn in cash and investments, and a debt-free balance sheet. The company should be able to raise debt easily, if needed to complete their upcoming projects.

The company has expressed its plans to add a new park every three to four years. They are also looking for partners, with whom they can sign management contracts, hence moving into a more asset light strategy. Wonderla at end of FY21, had 129 acres of undeveloped land available to them at their three existing parks. They should look to monetise this land bank, especially given the lower footfall in their older parks. While the setting up of the resort has not increased their revenue substantially, the company can look at setting up more rides, shopping malls, or convention centres to better utilise the vacant space.

The footfall and revenues in all three parks in the peak season has been positive, and should see customers coming back once the parks are allowed to re-open. To improve the performance in the off-season, better pricing and marketing strategy, with focus on tour groups and corporate trips is required. At first glance, the varied pricing strategy in peak season and off season is visible across the four Qs, and given better weather conditions should see better revenues in the coming years. The management has indicated, they will increase ticket prices only to keep in line with inflation, at least for the next few years. The food and merchandise is incredibly affordable inside the park, and the management can increase the variety there to increase revenues as well.

The earlier parks were set up on land acquired at very low prices, and hence the company has been able to generate high returns on capital there. With newer parks costing more to setup, the ROCE is expected to be in mid single digits initially for the newer parks, and then in the lower teens as they mature. Better utilisation of the existing cheap land bank, would be the best way to increase returns on capital.

Hi!

If you liked the above letter, share this with others who maybe interested. Consider subscribing to our newsletter. We will be posting one such article every month. See you soon!!

Thanks for reading!!

You can also follow us on twitter.